How to invest in real estate for beginners

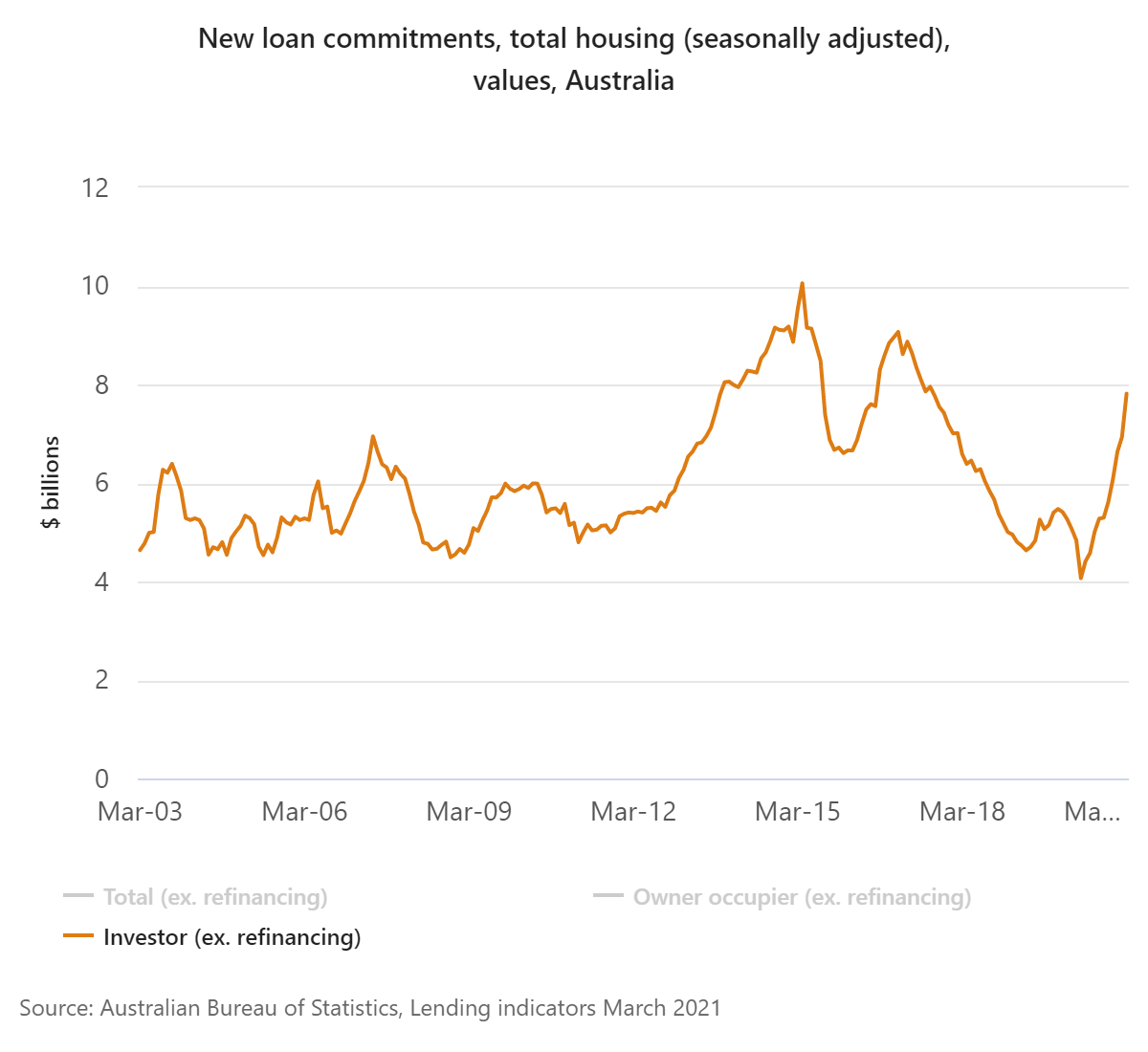

With interest rates at their lowest ever, now may be an ideal time to begin investing in real estate. Recent figures from Core Logic in April 2021, has also shown that national property prices have grown at a rapid pace of 6.8% over the past 3 months. With this increase in property prices combined with the fact that the low interest rates are expected to stay for a prolonged period2, investing in property is becoming an increasingly attractive opportunity. We can see this beginning to take place as investment lending has increased 54.3% over the year as of March 20213.

As the above graph4 illustrates that after a fall in investment lending over the past few years, since reaching its lowest point in May 2020, the investor market is beginning to rise. So if you’re looking to get your foot in the door and start investing, here are some things to consider to make sure you’re ready.

Step #1 Establish goals and create a plan

If you’re a beginner and want to get started with investing in real estate, to give yourself the best chance of success it is essential to outline your goals and create a plan. Investing in a rental property is a substantial financial commitment and the best results will usually come to landlords who take the time to get good advice and plan carefully before investing.

When creating an investment plan, here are some of our beginner tips to investing to consider:

Speak to your local Mortgage Choice broker to go through all the steps with you and get your investment plan started today!

Property investor guide

If you are looking to invest in property or simply exploring the possibilities, this guide will help you navigate the steps involved to kickstart your property investment journey.

Step #2 - The Deposit

Once you’ve got your investment plan ready, the next thing needed to make your investment property a reality is the deposit.

As with most home loans, you will typically need at least a 20% deposit when investing in real estate. In some cases, you may be able to get an investment loan with less than a 20% deposit, although you will likely need to pay lenders mortgage insurance (LMI).

If you are a beginner in investing but have owned your home for a few years, you may have enough equity built up to use instead of a cash deposit.

If you don't own your home and are still looking to invest in property with little money, another option available to you is a guarantor loan. A guarantor is a person - usually relative - who will have sufficient home equity in their property to provide a guarantee in place of a cash deposit.

With your deposit ready, it will be time to start thinking about what type of investment loan and interest rate will be most suitable for you. Interest rates on investment properties may be higher than owner occupied properties as investors can have a higher perceived risk to lenders compared to if you choose to live in the property. With this in mind, when deciding on your loan type and interest rate it is important to understand the difference between fixed and variable rate home loans in terms of features.

Your Mortgage Choice broker will be able to help you compare thousands of loans across various lenders to find the right loan for your investment property.

Step #3 - Calculate One Time and Ongoing Costs

While there are options available to getting an investment loan without a cash deposit, you will still need to consider the upfront and ongoing costs associated with a rental property.

One time costs

When getting any home loan, it is important to remember that there are certain upfront costs associated at the beginning of the process. These can include stamp duty, application fees and legal fees associated with taking out the loan.

When it comes to an investment property, these fees are still taken into account as well as other upfront costs to consider such as pre purchase pest and building inspections to ensure that your property is free from any building defects, illegal work or pest problems that will be costly down the line. Another cost to consider if you’re investing in a unit, apartment or townhouse is a strata search. A strata search, or strata report, will make sure that the building you’re investing in is free from issues of its own, by identifying whether there are existing disputes within the building, if there are outstanding repair bills or if the quality of repairs have been substandard.

Ongoing costs

When managing an investment property is it essential to be prepared for the ongoing costs that are associated. It is good to know that many of these expenses can be claimed on your tax - as best practice always check this with your accountant to be sure it's claimed correctly.

As a guide here are some of the most common ongoing expenses associated with managing a rental property:

- Accountant/ tax agent fees

- Body corporate fees

- Council and water rates

- Insurance - landlord insurance is available to provide a comprehensive level of protection for investors.

- Lease expenses including legal fees for drafting leases

- Land tax

- Letting and re-letting costs - including advertising costs

- Loan interest - factor the possibility of higher repayments into your budget if you use a variable rate loan

- Management fees paid to real estate agents - expect to pay around 7% of the gross rental

- Repairs and maintenance including cleaning or gardening costs

Find out in minutes how much you can borrow and the costs involved with our free home loan quote!

Calculate nowStep #4 - Applying for Your Investment Home Loan

Once you have planned out your strategy for investing in real estate and budgeted for the necessary costs associated, you are ready to apply for your investment home loan.

You can get an understanding of what types of investment loans are available and their associated interest rates here.

If you need any more advice to get started on your investment journey or are ready to apply, you can speak with a Mortgage Choice broker today, who will help map out your investment journey and go through the application process with you.

1 https://www.corelogic.com.au/news/home-values-continue-rise-pace-growth-loses-steam-april

2 https://www.corelogic.com.au/sites/default/files/2021-03/210301_CoreLogic_HVI.pdf

3 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/latest-release

4 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/latest-release