The Power of Extra Mortgage Payments: Maximizing Savings on an Owner-Occupier Loan

Paying off a mortgage faster can save you thousands in interest and help you own your home sooner. For owner-occupier loans with a 5.64% interest rate, adding a small extra payment each month can make a big difference. In this article, we’ll explore the benefits of paying an additional $115 per month on a $500,000 loan, $173 on a $750,000 loan, and $232 on a $1,000,000 loan. Using a 30-year loan term and a 5.64% fixed interest rate, we’ll break down the savings and time reductions these extra payments can achieve.

Understanding the Setup

For all three scenarios, we assume:

-

Loan term: 30 years

-

Interest rate: 5.64% pa

We’ll use standard amortisation calculations to show how extra payments reduce total interest and shorten the loan term. Let’s dive in.

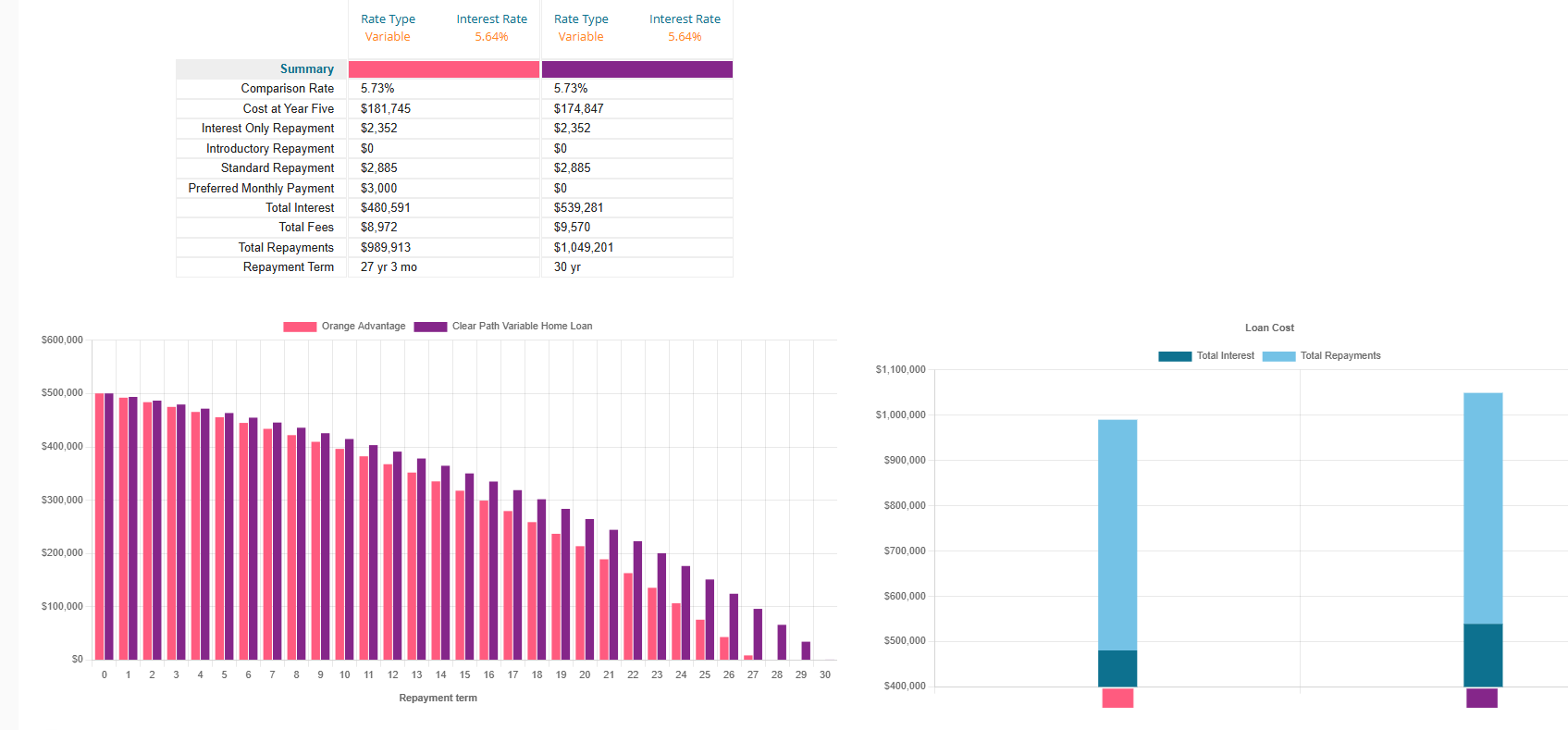

Scenario 1: $500,000 Loan with an Extra $115/Month

Without Extra Payments:

-

Monthly payment (principal + interest): $2,885

-

Total interest paid over 30 years: $539,281

-

Payoff date: 30 years from start

With an Extra $115/Month:

-

New monthly payment: $3,000

-

Total interest paid: $480,591

-

Payoff date: ~27 years and 3 months

Savings:

By adding just $115 per month—about the cost of a few restaurant meals—you save over $58,000 in interest and pay off your home nearly three years early. The extra payment reduces the principal faster, reducing the interest accumulating over time.

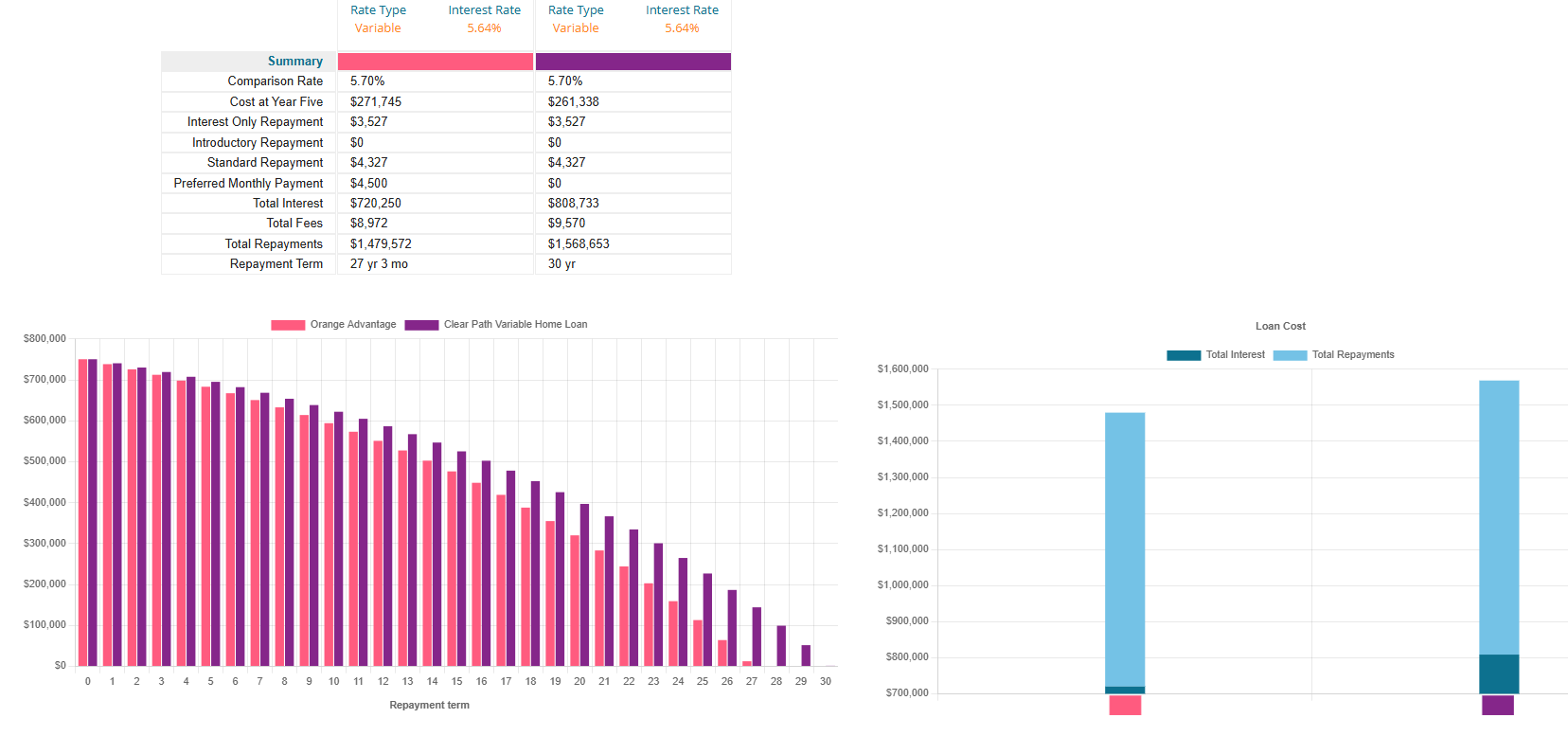

Scenario 2: $750,000 Loan with an Extra $173/Month

Without Extra Payments:

With an Extra $173/Month:

-

New monthly payment: $4,500

-

Total interest paid: $720,250

-

Payoff date: ~27 years and 3 months

Savings:

An extra $173 per month—roughly the cost of a utility bill or a streaming service bundle—saves you over $88,000 in interest and shortens your loan by nearly three years. The larger loan balance amplifies the impact of even modest extra payments.

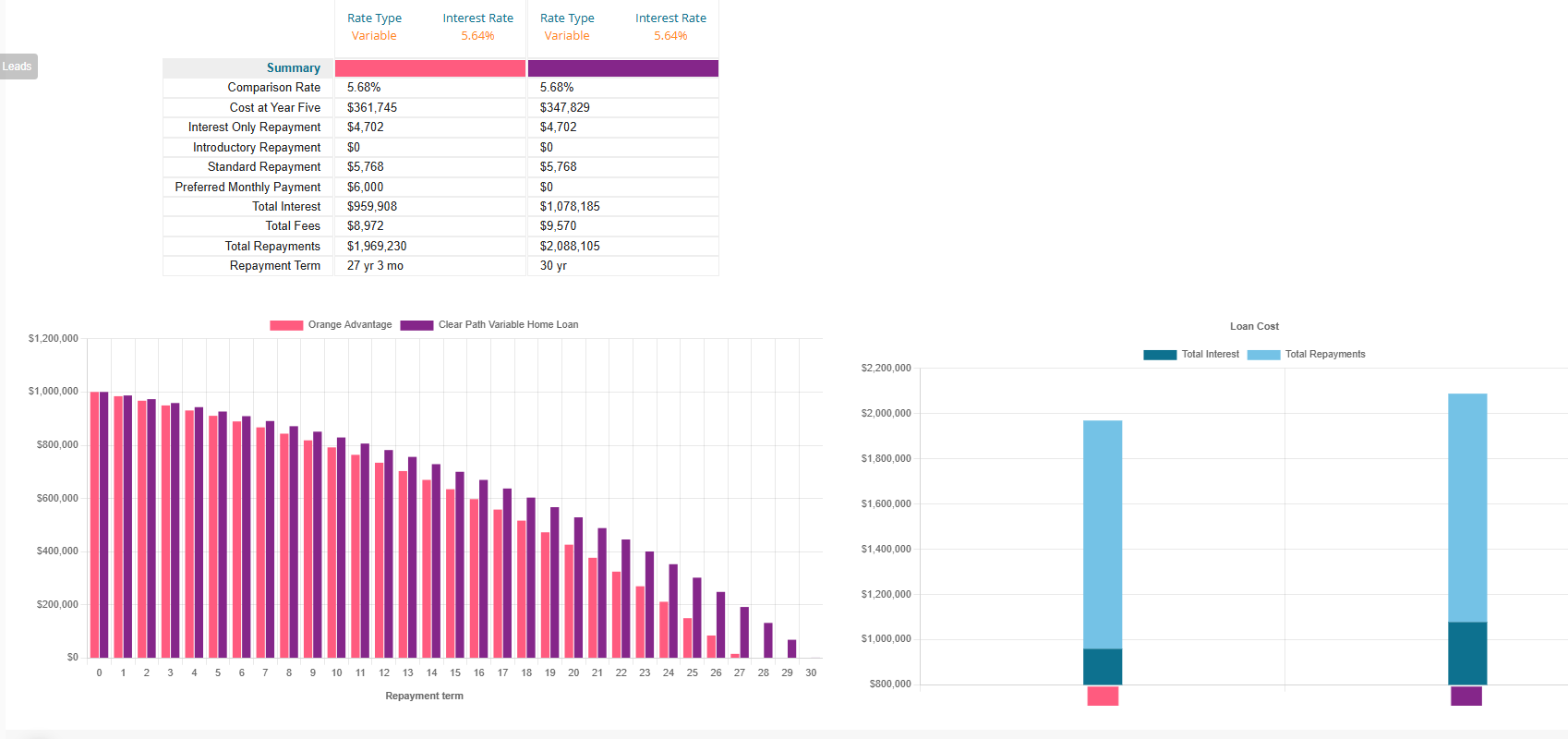

Scenario 3: $1,000,000 Loan with an Extra $232/Month

Without Extra Payments:

-

Monthly payment: $5,768

-

Total interest paid over 30 years: $1,078,185

-

Payoff date: 30 years from start

With an Extra $232/Month:

-

New monthly payment: $6,000

-

Total interest paid: $959,908

-

Payoff date: ~27 years and 3 months

Savings:

By adding $232 per month—similar to a car payment or a few nights out—you save over $118,000 in interest and pay off a million-dollar loan nearly three years early. This shows how impactful small extra payments can be on a large loan.

Why Extra Payments Work

Extra payments work because they target the principal early in the loan term. In a standard amortization schedule, early payments are mostly interest, with only a small portion reducing the principal. By applying extra funds directly to the principal, you lower the balance on which interest is calculated, creating a snowball effect that saves money and shortens the loan term.

Key benefits include:

-

Interest Savings: A lower principal means less interest accrues each month, saving you thousands.

-

Faster Payoff: Extra payments reduce the loan term, letting you own your home outright sooner.

-

Increased Equity: Paying down the principal builds equity faster, which can be useful for refinancing or selling.

Practical Tips for Extra Payments

Before starting, keep these tips in mind:

-

Confirm with Your Broker: No early repayment penalties apply.

-

Fit It in Your Budget: Make sure the extra payment is sustainable to avoid financial stress.

-

Automate Payments: Set up automatic payments to stay consistent.

-

Start Small if Needed: Even $50 per month can make a difference if the suggested amounts feel too high.

Is It Worth It?

With a 5.64% interest rate, extra payments effectively “earn” a guaranteed 5.64% return through interest savings. This can be competitive with low-risk investments, especially in volatile markets. However, if you have higher-interest debt (e.g., credit cards), prioritise paying that off first. For owner-occupiers, the emotional and financial freedom of owning a home sooner often makes extra payments a smart choice.

Final Thoughts

Adding $115 to a $500,000 loan, $173 to a $750,000 loan, or $232 to a $1,000,000 loan at a 5.64% interest rate can save you $58,690 to $118,277in interest and cut nearly three years off your mortgage. These small monthly increases—often less than everyday expenses—offer significant long-term benefits. Check with your Broker to explore your options, and consider taking this step toward a debt-free future.

Note: Calculations assume a 5.64% interest rate, 30-year owner-occupier loan with extra payments applied to principal. Actual savings may vary based on loan terms. Consult your Broker for precise figures.

Numbers are general in nature and may differ significantly from your circumstances.