Self Managed Super Funds | Mortgage Broker in Narellan, Campbelltown and Macarthur

How Do SMSFs Work?

In many respects, SMSFs work in much the same way as regular super funds. During your working life, you and your employer make contributions to the fund. The money is invested so that over time you build a decent pool of savings for retirement.

Who Can Start a Self-Managed Fund?

Just about anyone can establish an SMSF, though there is a limit of up to four members per fund. There are various costs associated with setting up and running an SMSF, so you’ll need sufficient money to make an SMSF worthwhile.

Valuable Tax Savings

Like all superannuation funds, SMSFs benefit from generous tax concessions. Contributions to the fund plus the returns on the fund’s investments are all lightly taxed, so more of your money goes to work for your retirement.

A Flexible Choice of Investments

An SMSF can have some advantages in terms of the mix of investments—within legal guidelines, including direct property. You’ll need a written plan that shows how the fund is investing for the benefit of its members.

An SMSF Helps You Save for Retirement

One of the key rules of SMSFs is that the fund can only be used to invest for retirement—you can’t normally access the money before reaching retirement age.

Can You Buy Property in an SMSF?

Yes, you can buy property in Australia under a Self-Managed Super Fund (SMSF) with lending. Here's how you can do it:

Steps to Buy Property with an SMSF Using Lending

1. Check Borrowing Capacity and Cash Flow: Before setting up an SMSF, as a mortgage broker, Melanie O'Connell specializes in SMSF loans. I can assist you in understanding how much your SMSF can borrow, the interest rates, monthly repayments, and the value of the property your SMSF can afford. It is also recommended you get financial advice from a planner.

2. Set Up the SMSF: Once you've had financial advice, you can establish your SMSF with a company trustee, as most lenders require this. Register the SMSF with the Australian Taxation Office (ATO) and set up a bank account for the SMSF. Your accountant can assist as well.

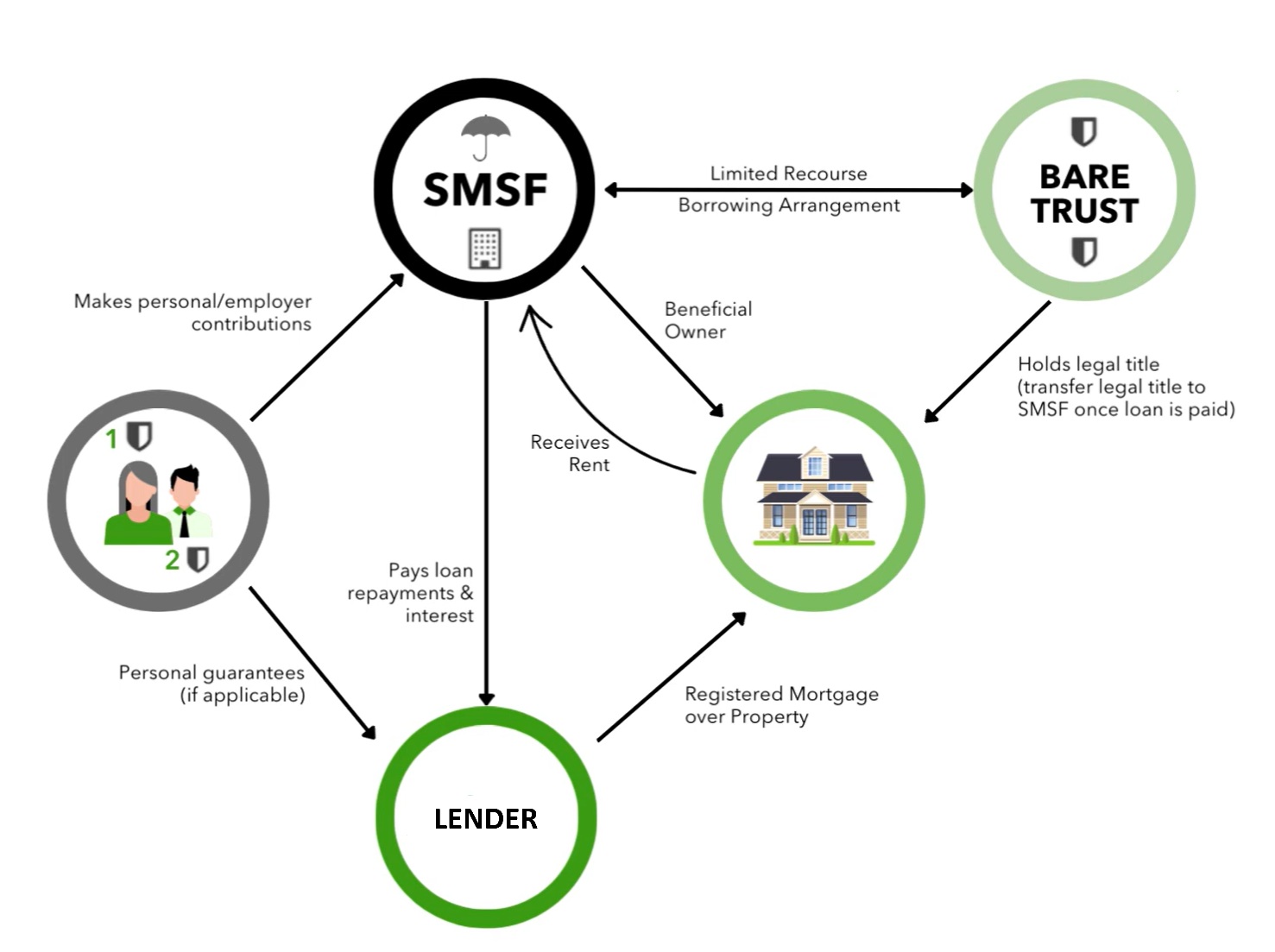

3. Set Up a Bare Trust: Create a bare trust (also known as a holding trust) where the property will be held. The bare trust will be the legal owner of the property, while the SMSF will be the beneficial owner.

4. Sign Purchase Contract and Bare Trust Documents: Once the SMSF and bare trust are set up, sign the purchase contract for the property and the bare trust documents.

5. Finance Approval and Deposit Payment: Obtain finance approval from a lender that offers SMSF loans. Pay the deposit for the property.

6. Settlement: Complete the settlement process, where the property is transferred to the bare trust, and the loan is drawn down.

7. Post-Settlement Housekeeping: Ensure all necessary documentation is in place and the property is correctly recorded in the SMSF's accounts.

Important Considerations

- Sole Purpose Test: The property must meet the sole purpose test of providing retirement benefits to fund members. It cannot be lived in or rented by a fund member or their related parties. It's a good idea when setting up an SMSF to have a basic knowledge of the Superannuation Industry (Supervision) Act 1993.

- Limited Recourse Borrowing Arrangement (LRBA): The loan must be a limited recourse borrowing arrangement, meaning the lender's recourse is limited to the property itself.

- Higher Costs: SMSF property loans tend to be more costly than other property loans. Ensure your SMSF has sufficient liquidity to meet loan repayments and other expenses.

- Liquidity Buffers: It's advisable to keep sufficient funds in your SMSF post-purchase as any shortfall out of pocket is considered a contribution into the super fund.

There is lots more to discuss. To organize pre-approval, please give Melanie a call today at (02) 4627 7447.