Investment Loans

Book an Appointment with your local Mortgage Broker on the Central Coast

Get Directions to our Central Coast Office

Investors vs Tenants - Central Coast

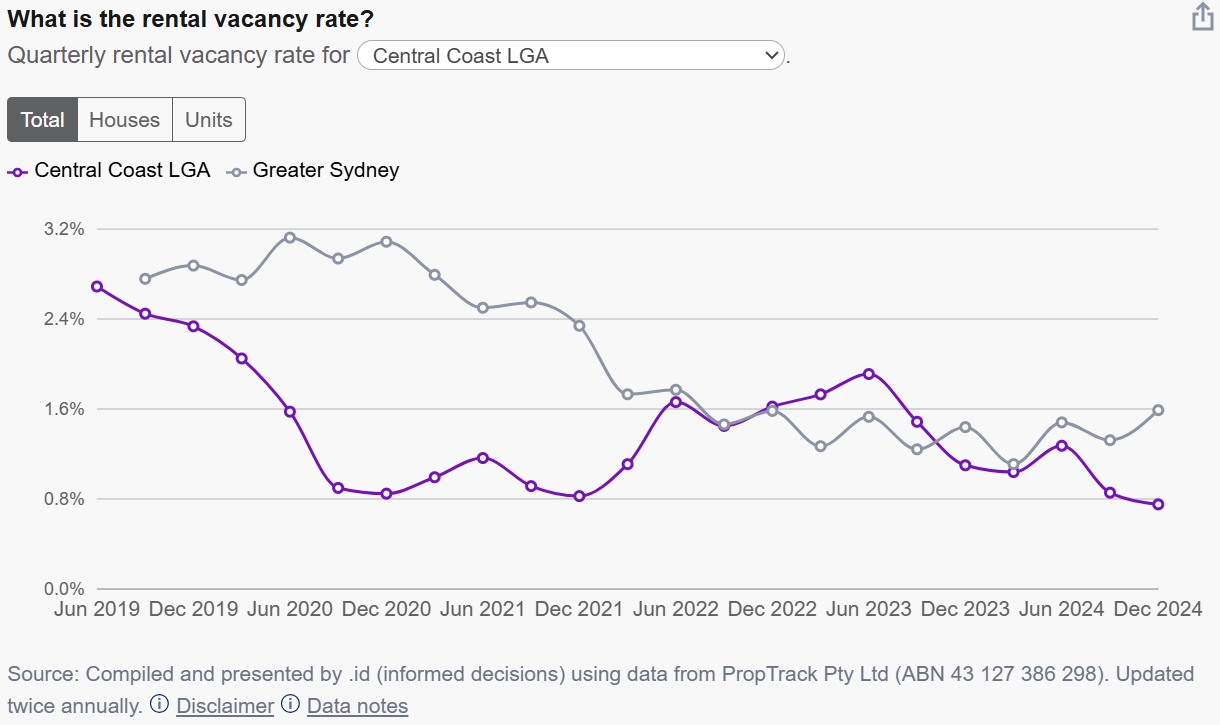

The Central Coast real estate market presents unique opportunities and challenges for property investors and tenants. With rental vacancy rates dropping to 0.8% in December 2024, as shown in the chart above, the market is highly competitive. This tightness benefits investors with potential for high rental yields but poses challenges for tenants seeking affordable rentals. Engaging experienced mortgage brokers, such as Michael Daniels and Philip Cooper from Mortgage Choice, can make a significant difference. Their expertise in the Central Coast’s diverse suburbs ensures tailored financial solutions for both investors and aspiring homeowners.

UPDATE | Central Coast Rental Market Dynamics | 20/05/2025

The chart illustrates the rental vacancy rates for the Central Coast Local Government Area (LGA) compared to Greater Sydney from June 2019 to December 2024. Key observations include:

- June 2019: Central Coast LGA started at 2.4%, slightly below Greater Sydney’s 3.0%.

- December 2020: Rates dropped to 0.8% for the Central Coast, compared to 2.8% for Greater Sydney.

- December 2023: Central Coast LGA peaked at 2.0%, while Greater Sydney was at 1.8%.

- December 2024: Central Coast LGA returned to 0.8%, with Greater Sydney at 1.4%.

This consistently low vacancy rate, often below Greater Sydney’s, highlights a competitive rental market, driving potential rental price increases. For investors, this suggests opportunities for higher yields, while tenants face increased competition for available properties.

Geographical Insights from the Central Coast Map

A map of the Central Coast reveals varying rental vacancy rates across suburbs, ranging from 0% to 3.5%. Key findings include:

- High Vacancy Areas: Inland regions like Brooklyn, Peat's Ridge, Yarramalong, Somersby, Mangrove Mountain, and Jilliby show higher vacancy rates (around 3.5%).

- Moderate Vacancy: Suburbs like Woy Woy, Toukley, Budgewoi, Bensville, Empire Bay and Wyong exhibit moderate vacancy rates (around 1.5% to 2%).

- Low Vacancy: Coastal areas like Gosford, Wamberal, Bateau Bay, Terrigal, Umina Beach, Kariong, Kincumber, Avoca Beach and The Entrance show very low vacancy rates (close to 0% to 0.5%).

This geographical diversity highlights the importance of local expertise in identifying areas with suitable vacancy rates for investment or homeownership. Coastal suburbs with near-zero vacancy rates indicate high demand, while inland regions with slightly higher rates may offer easier tenant acquisition.

The Role of Mortgage Brokers

Mortgage brokers like Michael Daniels and Philip Cooper from Mortgage Choice, based in Erina, bring over 35 years of combined banking and lending experience. They offer:

- Competitive Home Loans: Access to a wide range of lenders to secure favourable rates.

- Refinancing Options: Guidance on switching loans to optimise financial plans.

- Government Grants: Assistance for First-Time Buyers, Easing Entry into the Market.

- Investment Loans: Tailored solutions for leveraging equity in areas with favourable vacancy rates.

Their deep understanding of the Central Coast’s market, from coastal hotspots to inland regions, ensures clients make informed decisions based on current vacancy rates and market trends.

Benefits for Property Investors

The Central Coast’s rental market is characterised by low vacancy rates, with the highest recorded at 3.5% in some inland areas and as low as 0% in coastal suburbs. This generally indicates a tight market with high demand for rentals, resulting in strong rental yields. However, investors should consider:

- Low-Vacancy Areas: Coastal suburbs like Wamberal, Bateau Bay, Terrigal, Umina Beach, Kincumber, Avoca Beach and The Entrance offer high demand but may involve higher competition among landlords, which can potentially affect rental prices and tenant retention.

- Higher-Vacancy Areas: Inland regions, such as Brooklyn, Peats Ridge, Yarramalong, Somersby, Mangrove Mountain, Kariong, Gosford, and Jilliby, provide a balance between demand and supply, potentially making it easier to find and retain tenants, although yields may be slightly lower.

Michael Daniels and Philip Cooper can provide valuable insights into these market dynamics, helping investors choose locations that align with their investment goals and risk tolerance, securing investment loans tailored to the Central Coast’s unique market.

Support for Tenants

Tenants facing a competitive rental market, particularly in low-vacancy coastal areas, may find it challenging to secure affordable rentals. This situation may encourage a transition to homeownership. Michael Daniels and Philip Cooper can assist by:

- Guiding the Transition: Offering financial planning advice for moving from renting to owning.

- Accessing Grants: Helping navigate government schemes for first-time buyers, making homeownership more achievable.

- Providing Local Insights: Recommending suburbs with suitable vacancy rates, such as Wyong or Gosford, for potential buyers seeking affordable entry points.

Why Choose Michael Daniels and Philip Cooper?

With their extensive experience, Michael Daniels and Philip Cooper provide personalised, hands-on support. Their knowledge of the Central Coast’s unique layout—from beaches to national parks—ensures clients receive tailored advice. Whether you’re an investor targeting areas with balanced vacancy rates or a tenant aiming to buy, their expertise simplifies the process, making property goals more attainable.

Table: Key Services Offered by Michael Daniels and Philip Cooper

| Service | Description |

|---|---|

| Home Loans | Securing competitive rates for residential properties, tailored to individual needs. |

| Refinancing Options | Assisting with switching loans to better rates or terms, optimizing financial plans. |

| Investment Property Loans | Guiding investors on leveraging equity and understanding market trends for rentals. |

| Government Grants Access | Helping first-time buyers access grants to ease entry into the housing market. |

| Commercial Lending | Supporting business and commercial loans with expert financial advice. |

Conclusion

The Central Coast’s dynamic real estate market, characterised by low rental vacancy rates and a varied distribution across suburbs, necessitates expert navigation. Michael Daniels and Philip Cooper from Mortgage Choice offer the local knowledge and financial expertise needed to succeed, whether you’re investing in high-demand coastal areas or transitioning from renting to owning in more accessible suburbs. Their personalised approach ensures you achieve your property goals efficiently in this competitive market.