Mortgage Broker in Central Coast & Lake Macquarie

If you're looking for a trusted mortgage broker on the Central Coast, look no further than Mortgage Choice Central Coast. Our team of experienced brokers is here to help you navigate the complex world of home loans and find the right solution for your needs.

At Mortgage Choice Central Coast, we know that every borrower is different, which is why we take a personalised approach to every loan we work on. We'll take the time to understand your unique needs and goals and work with you to find a loan that meets your specific requirements.

With access to a wide range of lenders and loan programs, we can help you find the best rates and terms for your situation. Whether you're a first-time homebuyer or a seasoned investor, we have the expertise to help you achieve your financial goals.

Our team is committed to providing exceptional customer service and support throughout the entire loan process. We'll keep you informed every step of the way and ensure that you have all the information you need to make informed decisions.

So, if you need a mortgage broker on the Central Coast, look no further than Mortgage Choice Central Coast. Contact us today to schedule a consultation, and let us help you find the right loan solution for your needs.

Market Updates

05/05/2025

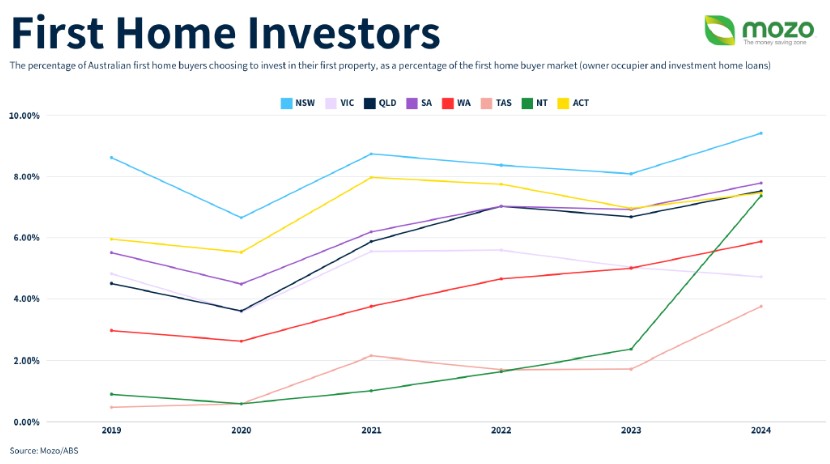

RENTVESTING - Find out why this buying strategy grows among first home buyers.

Rentvesting, the strategy of renting a home while investing in property elsewhere, has gained traction in Australia’s high-cost housing market.

This approach allows individuals to live in desirable areas while building wealth through real estate. However, it comes with both opportunities and challenges.

Benefits of Rentvesting

Affordable Lifestyle Choices: Rentvesting enables people to live in urban centres like Sydney or Melbourne, where buying is often unaffordable. Renters can enjoy vibrant locations while investing in more affordable regional or outer-suburban properties.

Wealth Building: Rentvestors can benefit from capital appreciation and rental income by purchasing investment properties in high-growth areas. Over time, this can create a diversified portfolio, strengthening financial security.

Flexibility: Renting offers mobility, ideal for those with dynamic careers or lifestyles. Rentvestors can relocate easily without the burden of selling a home, while their investment properties continue generating returns.

Tax Advantages: Australian tax laws allow deductions on investment property expenses, such as loan interest, maintenance, and management fees. Negative gearing can offset income tax, boosting cash flow.

Risks of Rentvesting

Market Volatility: Property markets fluctuate, and investment properties may not appreciate as expected. Economic downturns or oversupply in certain areas can lead to stagnant or declining values.

Financial Strain: Managing mortgage repayments alongside rent can stretch budgets, especially if interest rates rise or rental income falls short. Unexpected costs, like repairs, can further erode returns.

Tenant Issues: Investment properties rely on tenants, who may default on rent or damage the property. Vacancy periods can also disrupt income, increasing financial pressure.

Limited Control: Renters lack control over their living situation. Landlords may raise rent, sell the property, or impose restrictions, creating uncertainty for rentvestors.

Conclusion

Rentvesting offers a pathway to homeownership and wealth creation in Australia’s pricey market, blending lifestyle flexibility with investment potential. However, it demands careful planning and risk management. Prospective rentvestors should research market trends, assess their budget, and seek professional advice to balance the rewards against the uncertainties.

23/04/2025

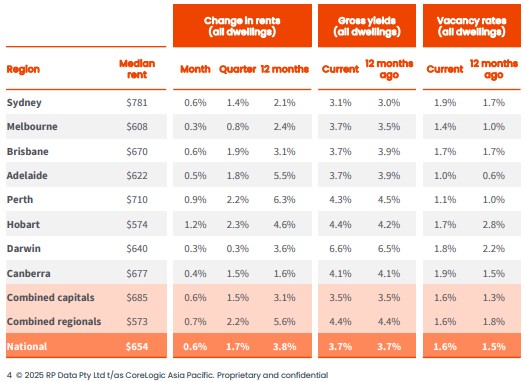

According to CoreLogic, regional rental vacancy rates are decreasing, while those in capital cities are generally increasing.

Sydney, Melbourne, Perth, Adelaide and Canberra have all seen an increase in rental vacancies. If this trend continues, the pressure on weekly rental amounts should decrease.

Interestingly, Sydney's rental vacancy rate is 1.9%, while the Central Coast rate is only 0.85%.

If you would like to discuss your investment property and funding options, please let me know.

18/04/2025

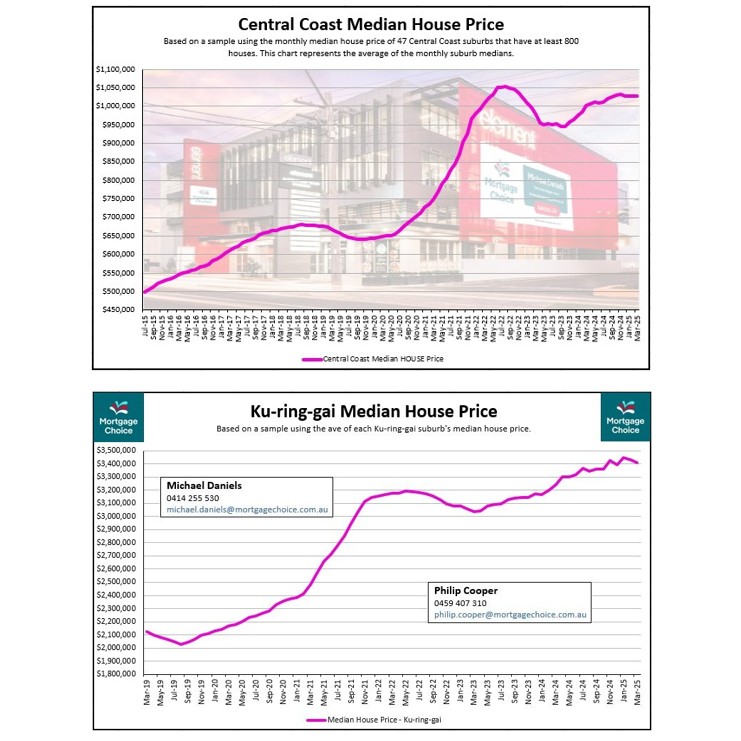

It pays to shop around when it comes to house prices; otherwise, you risk getting caught in a price bubble. The Hills District of Sydney is a prime example of this phenomenon, where prices have occasionally surged to rival those in the Upper North Shore. To gain perspective, we’ve started tracking the Ku-ring-gai and Hornsby council areas.

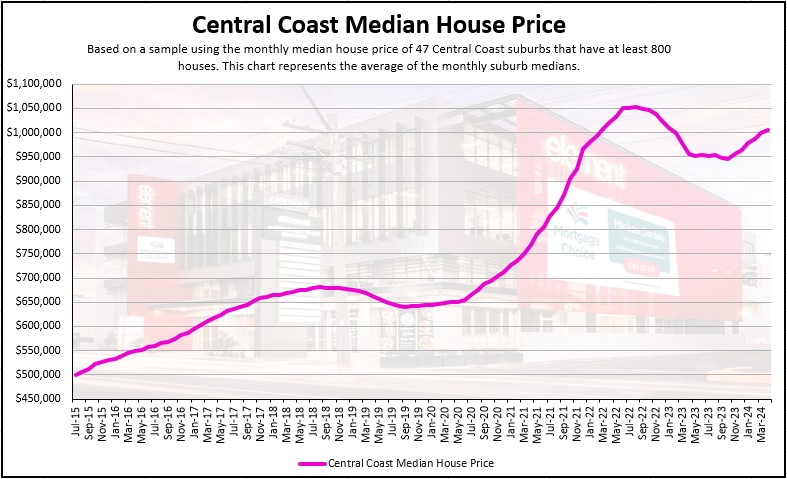

Since the onset of COVID-19 in early 2020, the median house price trends in the Central Coast and Ku-ring-gai council areas have diverged. The Central Coast saw a steady increase, peaking at approximately $1,050,000 by mid-2022, a 75% rise from its pre-COVID level of $600,000. Ku-ring-gai, starting at a higher baseline of $2,200,000, experienced a sharper initial surge, reaching $3,200,000 by mid-2022—a 45% increase. Post-2022, both regions experienced slight declines. However, Ku-ring-gai has since surpassed its COVID-era peak, while the Central Coast has yet to regain those heights.

Could our market still have growth potential, or have these Sydney regions already overperformed?

04/04/2025

02/11/2024

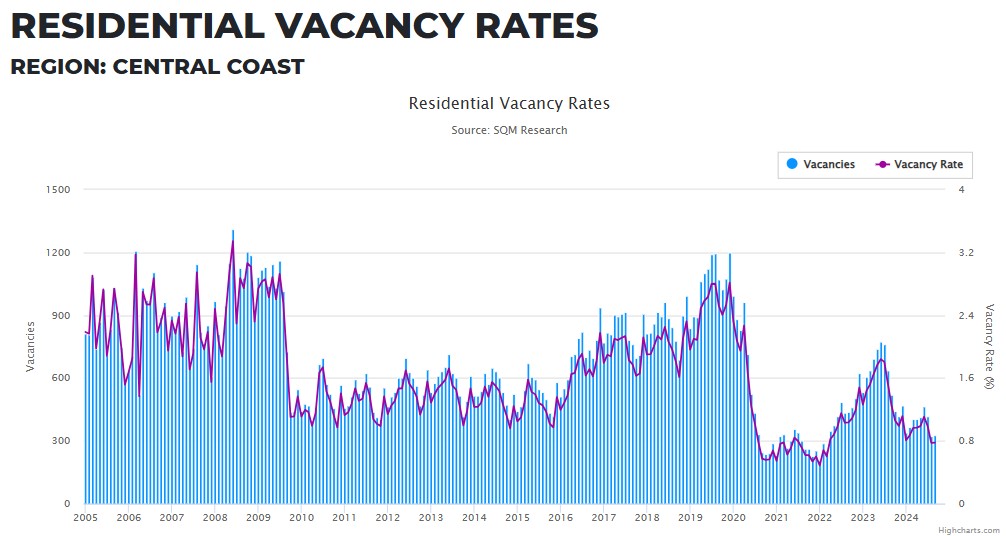

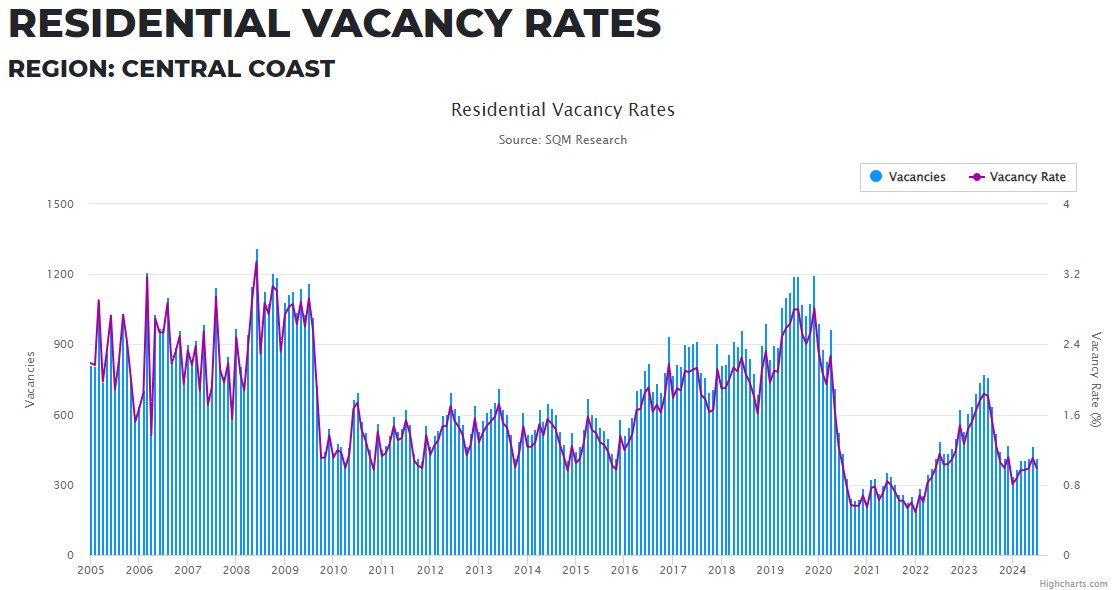

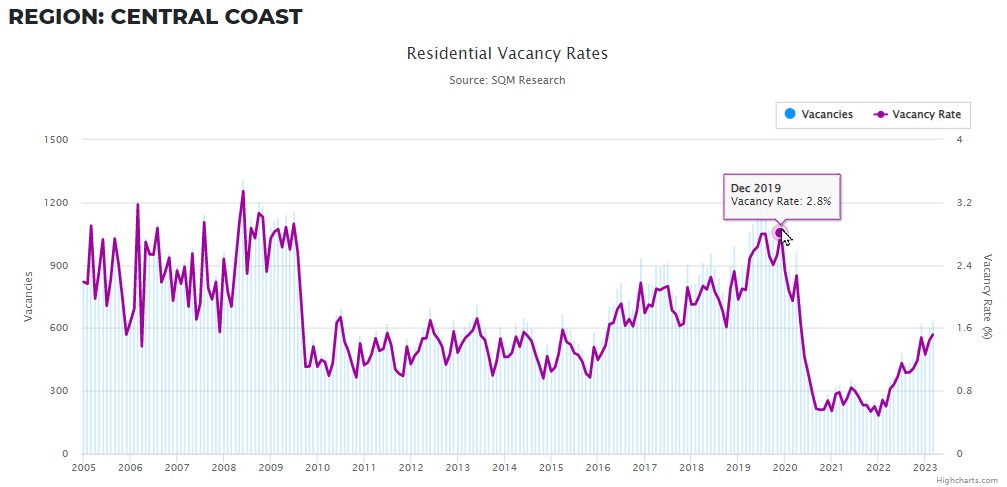

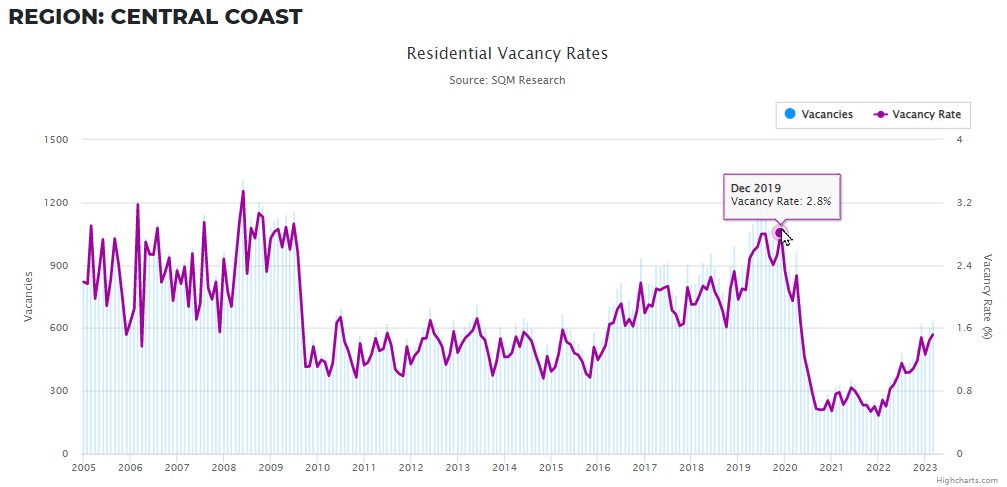

The Central Coast rental market continues to need more housing stock.

As you can see from this chart, the rental vacancy rate was between 2.4% and 3.2% just before COVID-19. COVID-19 saw many Sydney people move to the Central Coast, and the vacancy rate dropped to 0.70%, the lowest result on record.

Unsurprisingly, as the lockdowns ended, many of these Sydney people moved back to Sydney. This saw the vacancy rate lift back up to 2%, which took the pressure off asking rents and renters trying to find a place to live.

Surprisingly, the Central Coast is filling up again. I suspect this is a combination of Sydney becoming too expensive and the large levels of immigration that are overwhelming the number of available dwellings.

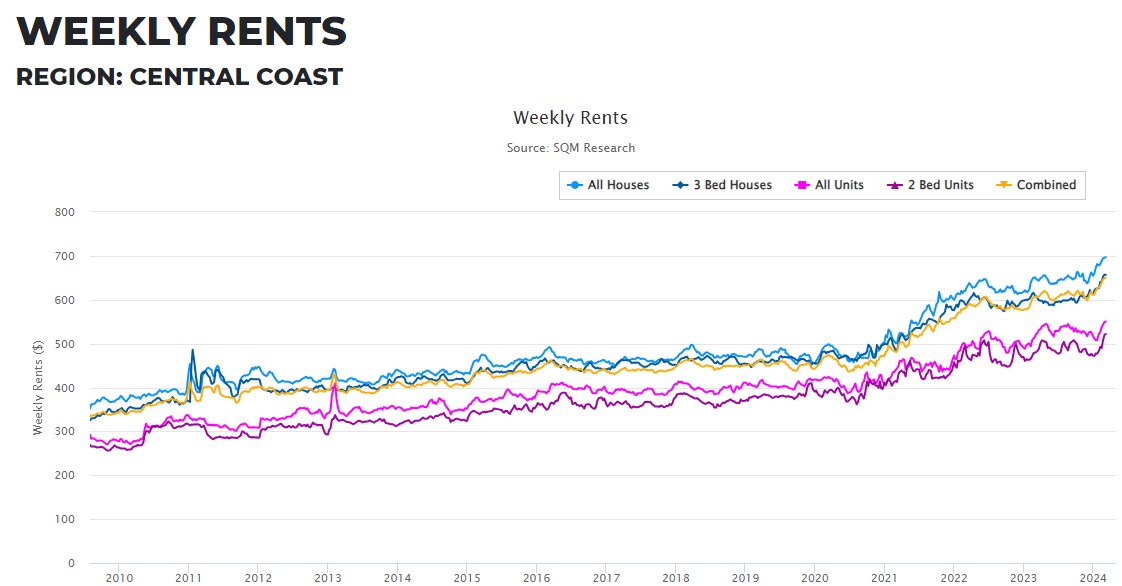

So, what does this mean for the renters on the Central Coast? Asking rents are rising dramatically. The median asking rent for a house is now over $700 per week, and the median unit rent is now $545 per week.

As a comparison, $700 per week is the approximate cost of a $500,000 mortgage with an interest rate of 6.15% over a 30-year term.

Please call us at Mortgage Choice Central Coast to discuss your home or investment property ownership opportunities.

21/08/2024

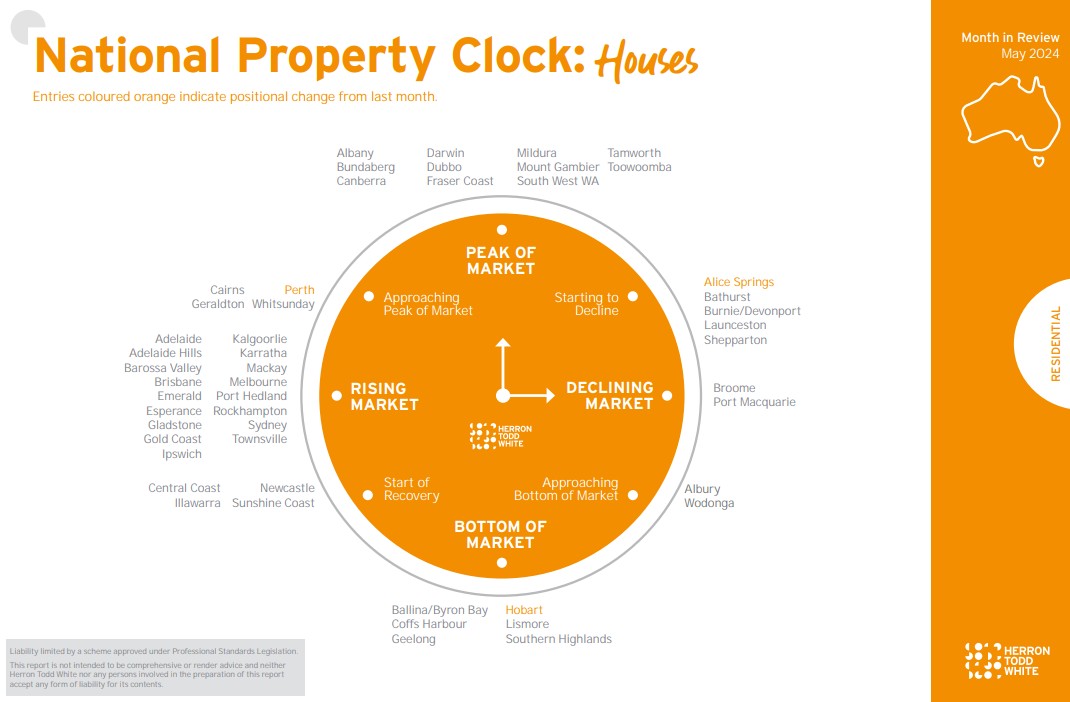

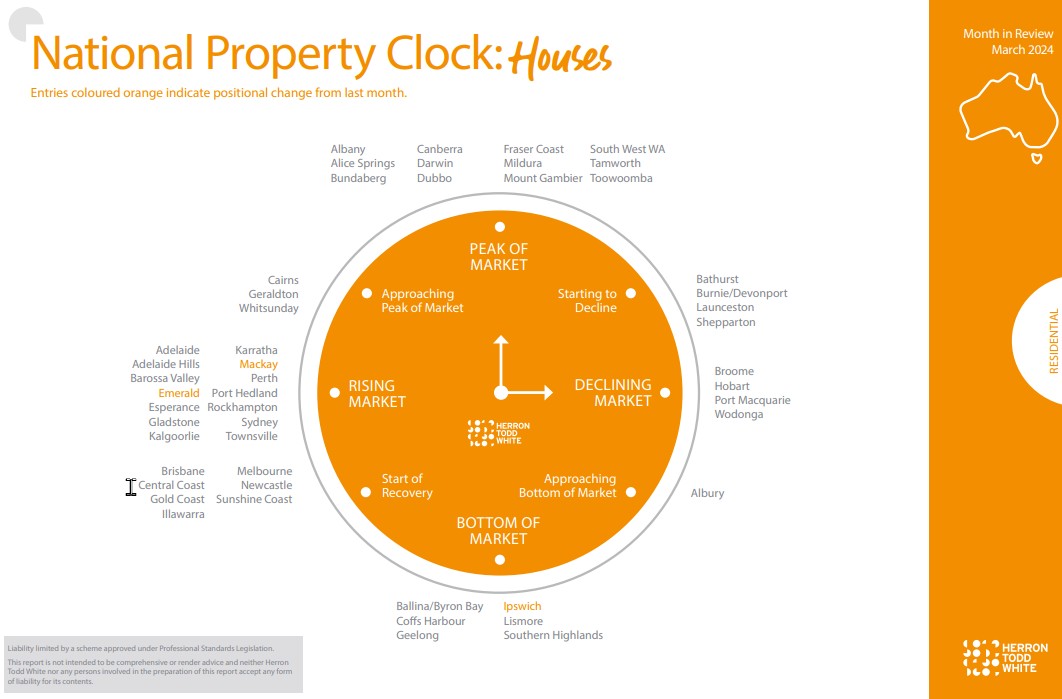

Central Coast Houses remain in the "Start of Recovery" phase (May 2024)

According to the Herron Todd White valuation firm's monthly property clock report, the Central Coast house markets are in the "Start of Recovery" phase.

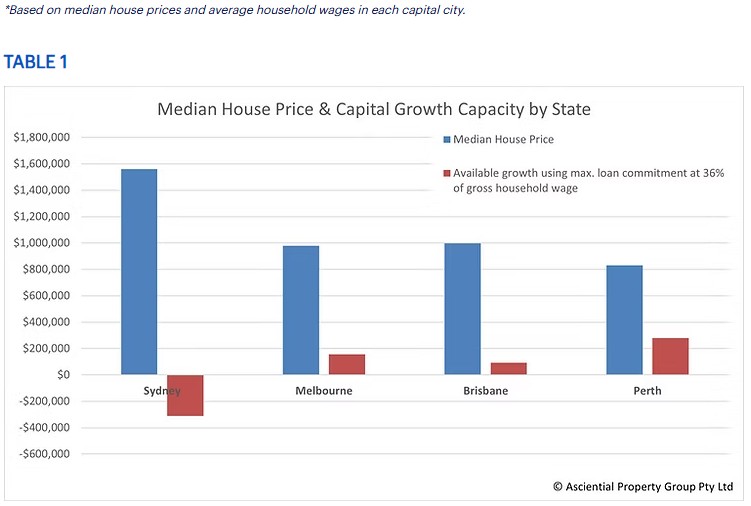

As we have been pointing out for a few months now, the Central Coast residential housing markets have benefited from the lack of affordability in the Sydney Market. Interestingly, HTW has placed Sydney in the "Rising Market" category, so we can probably expect the overflow demand to continue.

Should you need advice from an experienced Central Coast Mortgage Broker, please call Mortgage Choice Erina.

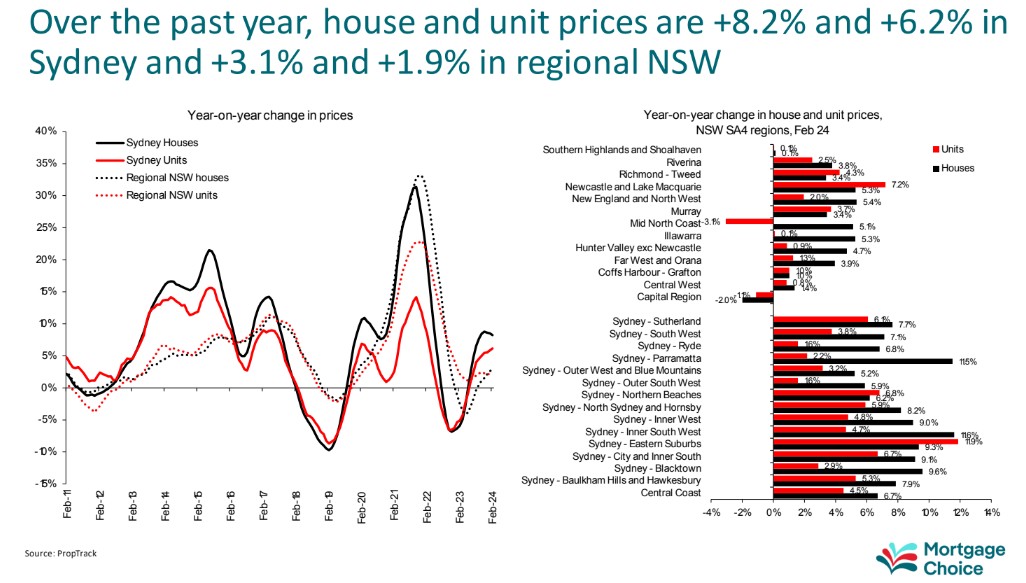

Does the Central Coast property market follow Sydney? (May 2024)

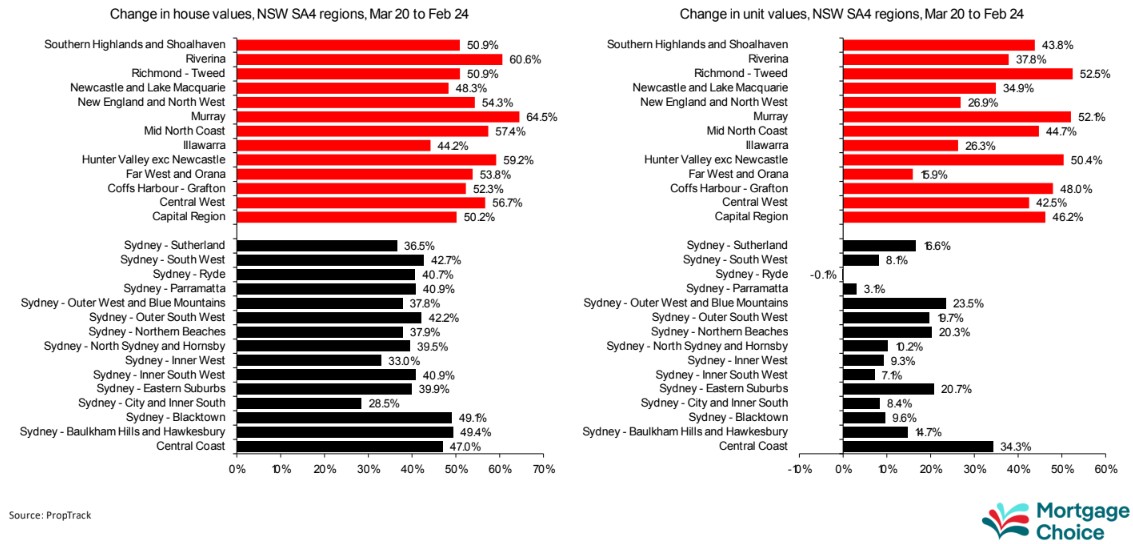

These charts give us some valuable information about the performance of Central Coast house prices.

1. Between March 2020 and February 2024, house prices rose by 47%, and unit prices rose by 34.3%.

2. Central Coast units outperformed all fifteen Sydney markets but came tenth out of thirteen regional markets.

3. Central Coast house prices rose, placing them third out of fifteen Sydney markets, but only outperformed one of the thirteen regional markets.

Central Coast houses and units have behaved more like regional NSW markets. COVID-19 societal lockdowns impacted these results via a Sydney exodus. The post-2022 results will be interesting to observe.

Mortgage Choice Erina will continue to provide data to help you understand our market and its future.

The Central Coast median house price breaches $1,000,000 again (April 2024)

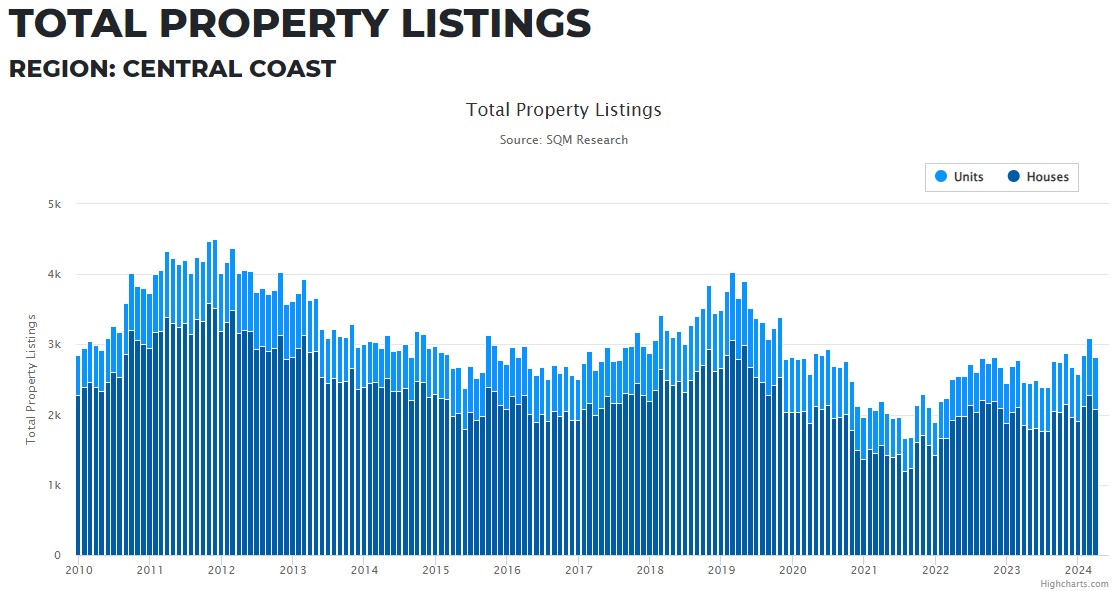

Property listings trending higher on the Central Coast (May 2024)

Although the number of residential property listings on the Central Coast is trending higher, the most recent month saw a dip, and we have not returned to pre-COVID levels.

Whilst the supply of property available for purchase remains relatively constrained, prices will continue to rise in a high-demand market. We will be keen to monitor this chart in the coming months to see if supply continues to reduce.

Please give us a call at Mortgage Choice Erina if you would like to discuss your home loan or investment plans.

"Start of Recovery" for Central Coast Houses (March 2024)

"Start of Recovery" for Central Coast Houses (March 2024)

Central Coast Houses out-performing Units (March 2024)

Units vs Houses on the Central Coast (March 2024)

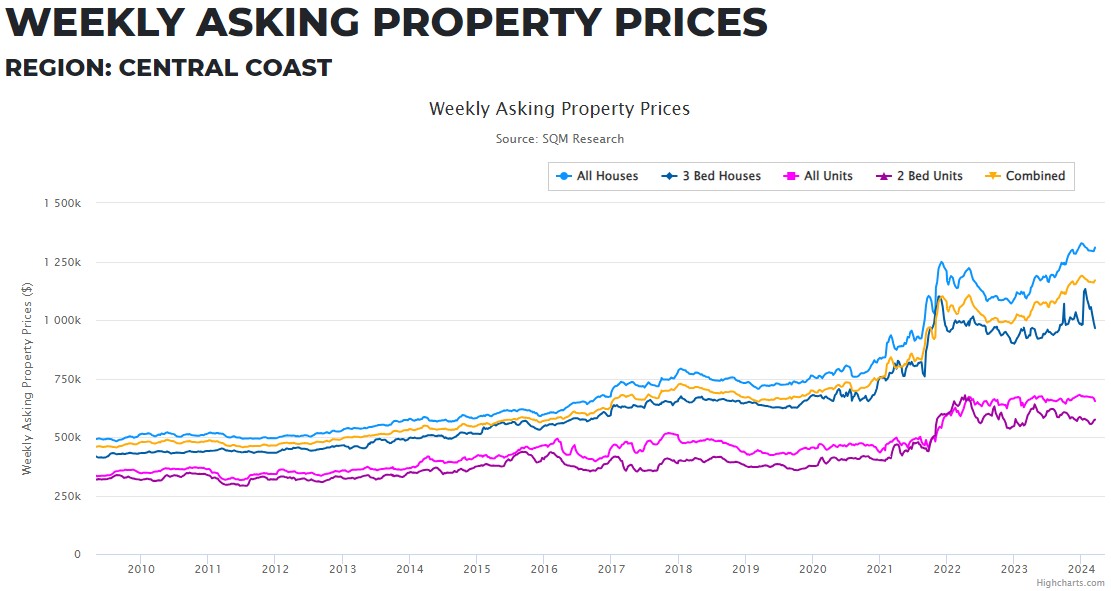

This chart shows that house asking prices are trending higher than unit asking prices.

Units have remained steady for the last two years. House asking prices are now climbing higher after a brief fall.

The 'All Units' data shows the median asking price was $452,842 in March 2020. Four years later, it is $653,752, a 44.80% growth in four years.

The 'All Houses' data shows the median asking price was $774,072 in March 2020. Four years later, it is $1,309,548, a 69.17% growth in four years.

This chart shows that the proportion gap between unit and house prices was steady between 2009 and 2016. Unit prices were roughly 65% of house prices. As of March 2024, unit prices are now 49% of house prices.

We at Mortgage Choice Erina can only speculate why this has happened, but the supply of new houses has been limited, and the supply of units is accelerating. There are also some indicators that Sydney house seekers are being priced out of their market and looking for more affordably pastures on the hashtag#CentralCoast.

Please call us if you would like to discuss your property-buying plans. The property buying process starts with understanding how much you can borrow.

Asking Rents continue to rise on the Central Coast (March 2024)

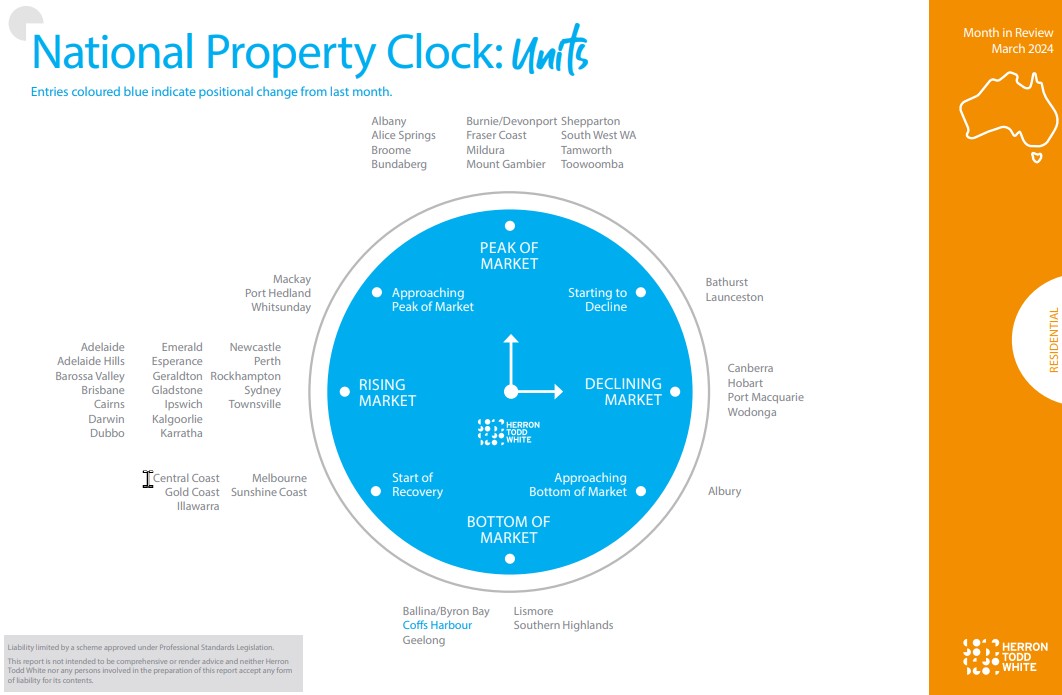

Units come into the Central Coast Picture

The extraordinary increase in #CentralCoast house prices over the last five years has shifted our attention to more affordable options. And I'm not talking about Queensland.

Units and townhouses are now in focus, particularly for first-time home buyers, investors (looking for cash-flow-positive options) and downsizers.

First-home buyers in Sydney have always seen units as the obvious entry point into the market. This is now a more common reality for Central Coast first-home buyers.

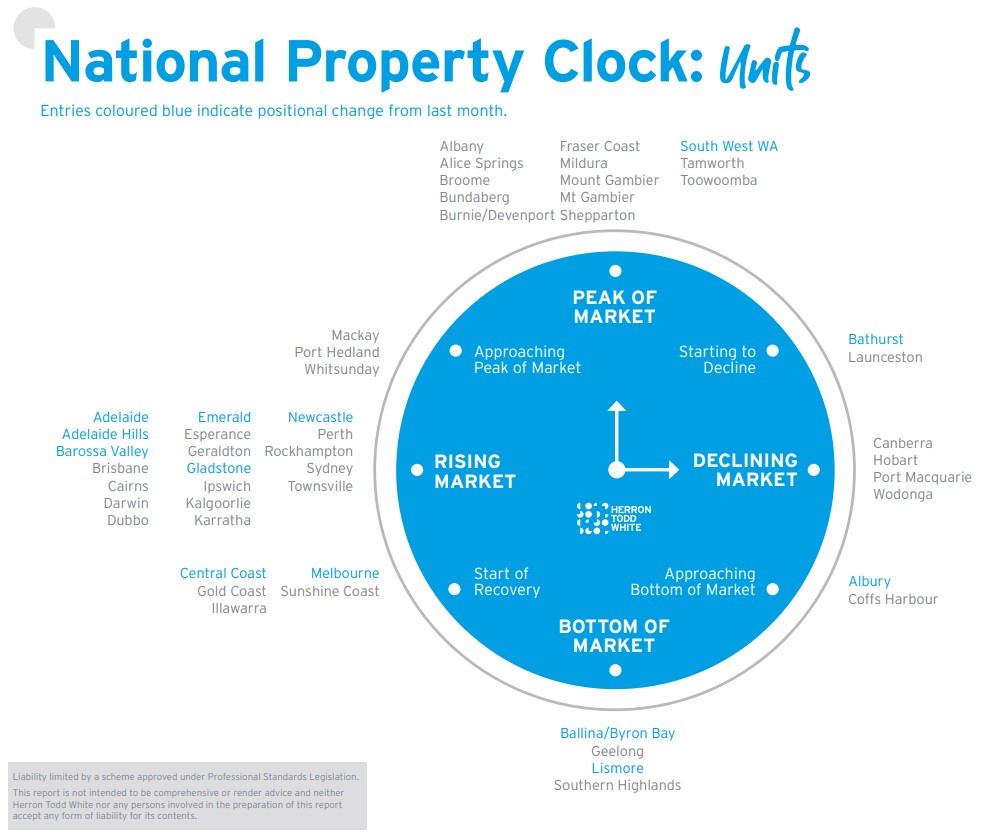

One of Australia's biggest residential valuation firms, Herron Todd White, produces a monthly infographic that utilises their valuers to estimate the stage of the local property cycle.

The Central Coast unit market moved from the "bottom of the market" to the "start of recovery" phase.

If you would like to discuss purchasing a unit or townhouse, please call me about establishing a pre-approval.

Big Bank RBA Cash Rate Forecasts (March 2024)

Compare your Interest Rate (February 2024)

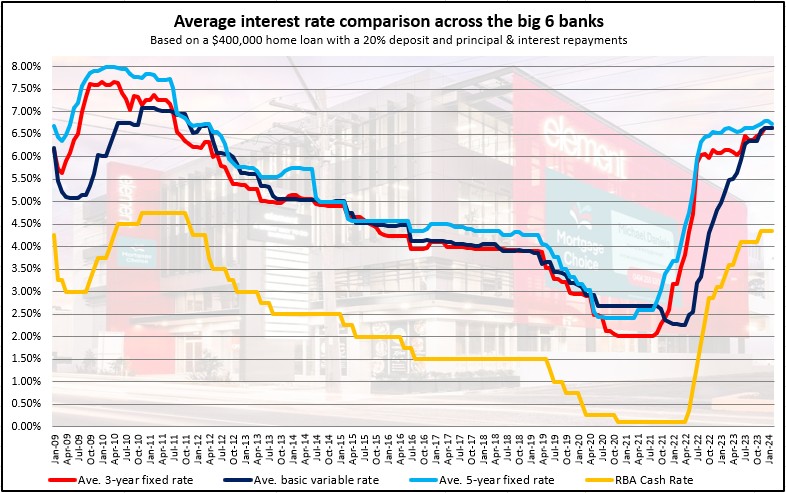

Our Mortgage Choice Erina interest rate chart has been updated for February 2024.

We recommend you compare your mortgage interest rate to this chart and call us if your rate looks too high.

Central Coast Rental Vacancy Rates (April 2023)

Central Coast Rental Vacancy Rates (April 2023)

Average Big 4 Bank interest rate chart (April 2023)

Our "Mortgage Choice Erina" monthly average interest rate chart has been updated for April 2023.

As you can see, the average 3-year fixed rate and the average 5-year fixed rate have stabilised and even slightly reduced.

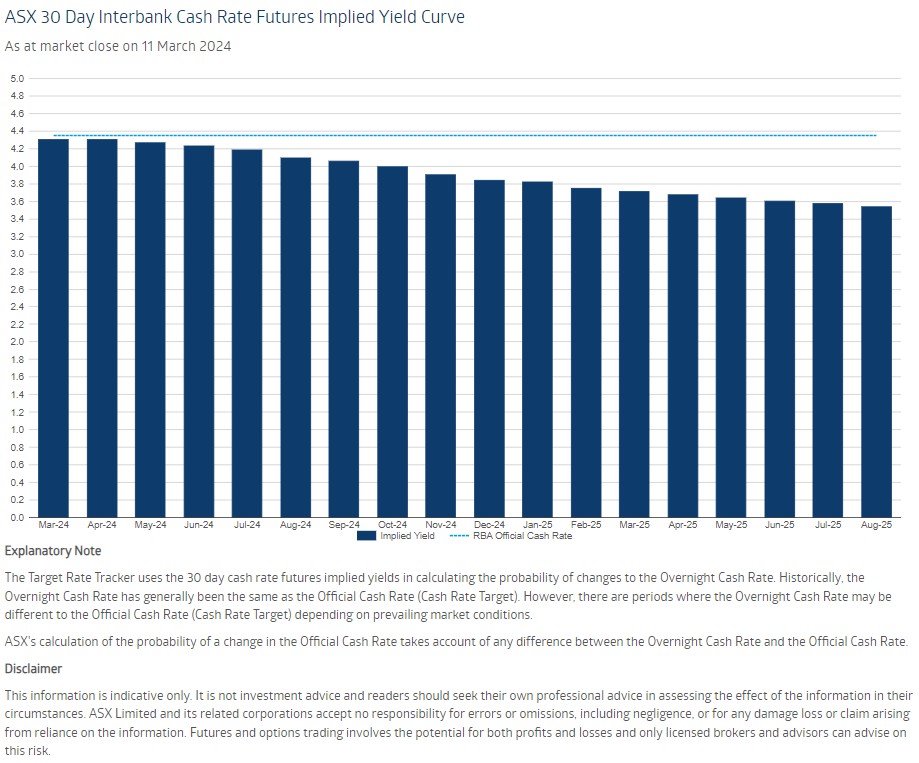

The massive increase in variable interest rates by the Reserve Bank of Australia is hopefully coming to an end very soon.

Most of the major bank economists are predicting one or two more 0.25% increases, however, the ASX futures market is predicting that we may have peaked.

Our Central Coast economy would benefit enormously if people ensure they are not paying too much to the banks. The money being wasted on high-interest rates could be better spent in our local economy.

If you would like to take a look at your interest rates please contact us for a review.

The Herron Todd White Property Clock (March 2023)

Central Coast Gross Rental Yields (March 2023)

One of the most important ratios for a Central Coast property investor to consider is the GROSS RENTAL YIELD.

This is simply the annual rent of a property expressed as a percentage of the property value. We are used to using this ratio for investments like Term Deposits. We express the annual cash income as a percentage of the cash deposit.

This chart is very important for Central Coast investors.

Some interesting Mortgage Choice Erina observations:

1. The highest Gross Rental Yield for 2-bedroom units was 5.7% in December 2019 (right before Covid).

2. The current 2-bedroom unit Gross annual rental yield is currently 4.20%.

3. The highest Gross annual rental yield for all houses was 4.7% back in January 2012.

4. The current gross annual rental yield for all Central Coast houses is only 3%.

Interestingly, whilst gross rents rose significantly since the start of Covid, property prices rose faster, this saw the gross annual rental yield slightly decline for both units and houses.

The current trend appears to show a gradual recovery of gross annual rental yields, despite rent amounts remaining stable.

Please give us a call if you would like to talk about your investment options.

As they say, the best time to plant a tree was 20 years ago. The second best time is now.

Central Coast Median House Price (December 2022)

The worm is turning.

As you can see from the chart below. Our Mortgage Choice Erina median house price chart for the Central Coast of NSW is showing a reduction.

The median house price has reduced from the peak of $1,052,654 (August 2023) to $1,029,958 (December 2023). It would be hard to imagine these house prices not reducing further over the coming months as interest rates continue to rise, reducing borrowers' access to funding.

Although house prices are starting to reduce, they are still at historically high levels. Now is the time to use these higher valuations in your favour.

If your debt is relatively low compared to these higher prices, we might be able to use this equity position to negotiate a better interest rate. Please send us an email if you would like us to investigate this option.

Central Coast House Prices - May 2023

Our Central Coast house price results are out for May 2023.

Whilst the median house price dropped from $955,202 to $951,420, the rate of decline has slowed this month. The drop from March to April was almost $20,000.

This median house price level was last seen back in December 2021. Amazingly, only 18 months prior to this date, the median house price was $300,000 lower. To put this into mortgage perspective, an additional $300,000 in borrowings would have a weekly repayment of $415, based on a 6% interest rate over a 30-year loan term.

The ranked table below shows 20 Central Coast suburbs with the highest number of houses. We have shown you the median house prices from January to May. As you can see, the trend is heading down for every suburb on this list. Although, some have fallen quite a lot more than others.

As always, we encourage you to call or email us if you have any questions at all.

The above chart (Feb 2024) compares the Central Coast market to the various Sydney and NSW markets.

As you can see, our units and houses have underperformed in most Sydney markets but overperformed in almost all NSW regional markets.

This chart also confirms our data showing that house prices outperform unit prices on the Central Coast. Potentially, the large increase in new unit supply compared to lower land release numbers makes units more affordable.

If you would like to talk to us about your property plans, please give us a call to discuss your options.