Mortgage Broker Wyoming

Book an Appointment with Michael Daniels, Mortgage Broker Wyoming

Get Directions to Our Central Coast Office

WYOMING UPDATE | 07/06/2025

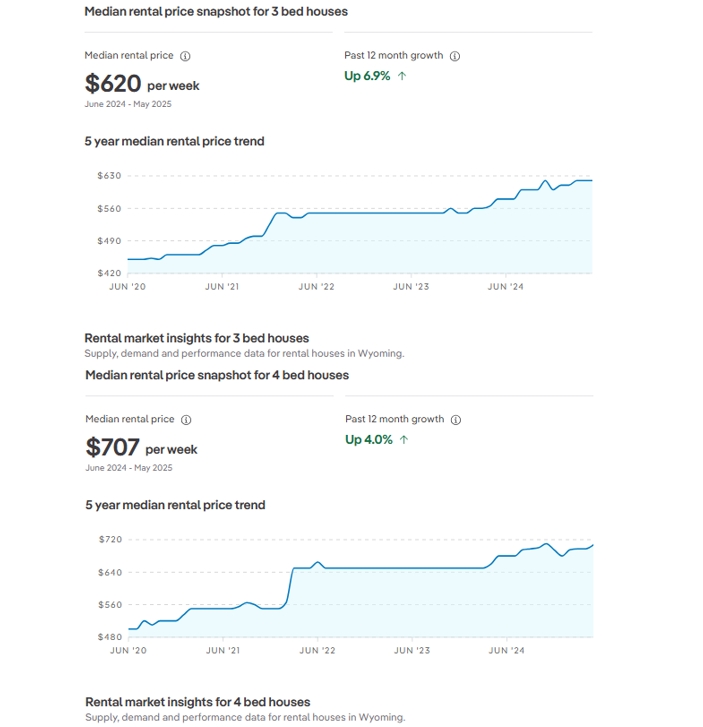

The attached charts provide a detailed snapshot of the median rental prices for 3-bedroom and 4-bedroom houses in Wyoming from June 2024 to May 2025. The median rental price for 3-bedroom units is $620 per week, representing a 6.9% increase over the past 12 months. In contrast, 4-bedroom units have a higher median rental price of $707 per week, with a slightly lower growth rate of 4.0% over the same period. This indicates a $87 weekly difference, highlighting that 4-bedroom homes command a premium, likely due to increased space and demand.

Over the five years (June 2020 to June 2024), both property types exhibit a steady upward trend. Three-bedroom rentals have increased from approximately $420 to $620, while four-bedroom rentals have risen from around $480 to $707. The growth rate disparity suggests that 3-bedroom units may be experiencing stronger demand or supply constraints recently.

For those considering investment or relocation, consulting a mortgage broker in Wyoming can provide tailored financial advice. The rental market's upward trend underscores the importance of expert guidance from a mortgage broker in Wyoming to navigate purchasing or refinancing options effectively. This data reflects a robust rental market, with potential opportunities for property investors.

WYOMING UPDATE | 02/06/2025

Navigating the Wyoming, NSW residential property market can be complex, but with a dedicated mortgage broker in Wyoming, you can secure the best home loan tailored to your needs. Whether you're a first-time homebuyer, an investor, or looking to refinance, our team specialises in the Central Coast property market, offering personalised advice and access to competitive loan rates. With our deep understanding of Wyoming’s unique housing trends, we help you make informed decisions to achieve your property goals.

Wyoming Property Market Overview

The Wyoming, NSW property market, located in the heart of the Central Coast, offers a blend of affordability, lifestyle, and investment potential. As a mortgage broker in Central Coast and Wyoming, we stay updated on the latest market trends to guide you through purchasing or investing in this vibrant suburb. Below, we examine key metrics, including median house prices, rental yields, weekly rents, rental vacancy rates, and stock turnover, to help you understand the market dynamics.

Median House Prices in Wyoming

The median house price in Wyoming, NSW, is approximately $870,000, reflecting a year-on-year growth of 3.57% and a two-year increase of 11.53%. This steady appreciation makes Wyoming an attractive option for homebuyers and investors seeking value in the Central Coast region. Compared to the national median house price of $485,000, Wyoming offers a balance of affordability and growth potential, making it a hotspot for those working with a mortgage broker in Central Coast or Wyoming. The median price for three-bedroom homes can reach up to $1,000,000, depending on location and property features, providing a range of options for buyers.

Rental Yields in Wyoming

For property investors, rental yields are a critical factor. Wyoming boasts a median rental yield of 4.10% for houses and 4.57% for units, making it a strong performer in the Central Coast region. These yields are particularly appealing when compared to other NSW suburbs, where yields often fall below 4%. The Central Coast, including Wyoming, has been highlighted as a top area for rental yields, with yields ranging between 4.2% and 4.5% across the region. Working with a mortgage broker in Wyoming can help investors secure financing to capitalise on these attractive yields.

Weekly Rents in Wyoming

The median weekly rent in Wyoming is $650 for houses and $485 for units. These figures reflect the suburb’s strong rental demand, driven by its proximity to amenities, schools, and transport links. Compared to nearby Newcastle, where median rents are $650 for houses and $570 for apartments, Wyoming offers competitive rental prices, making it a desirable location for both tenants and investors. A mortgage broker in Central Coast can assist in structuring loans to maximize returns on rental properties in Wyoming.

Rental Vacancy Rates in Wyoming

Rental vacancy rates in Wyoming are notably low, aligning with the Central Coast’s tight rental market. Sydney’s vacancy rate is currently at 1.4%. While specific data for Wyoming is not always isolated, the Central Coast region mirrors this trend with vacancy rates well below the healthy benchmark of 3%. Low vacancy rates indicate strong demand for rental properties, which reduces the risk for investors and ensures consistent rental income. Our mortgage broker in Wyoming services can help you navigate this competitive market to secure investment properties with minimal vacancy risks.

Stock Turnover and Market Dynamics

Stock turnover in Wyoming has increased by 10.00% compared to the previous year, with houses and townhouses taking an average of 43 days to sell. This relatively quick turnover reflects a competitive market driven by low inventory and high demand. The tight inventory levels, similar to trends observed across Wyoming’s state-wide market, contribute to upward pressure on prices, benefiting sellers. For buyers, partnering with a mortgage broker in Central Coast ensures you’re pre-approved and ready to act swiftly in this fast-moving market.

Why Wyoming is a Great Place to Buy or Invest

Wyoming, NSW, located in the Central Coast Council area, is a serene suburb known for its natural beauty, family-friendly environment, and proximity to amenities. With a population of approximately 10,132 as of 2016, Wyoming offers a mix of suburban charm and urban convenience. The suburb spans 7.2 square kilometres and features 22 parks, covering nearly 18.2% of its area, making it ideal for families and outdoor enthusiasts. Key amenities include Wyoming Shopping Village, West Gosford Shopping Centre, and schools like Wyoming Public School and Our Lady of the Rosary Catholic Primary School.

The suburb’s demographic, predominantly couples with children, supports a stable housing market. Homeownership rates have slightly declined from 70.1% in 2011 to 66.1% in 2016, indicating a growing rental market that benefits investors. With mortgage repayments typically ranging from $1,800 to $2,399 per month, a mortgage broker in Wyoming can help structure affordable loan options to suit your budget.

Working with a Mortgage Broker in Wyoming

A mortgage broker in Central Coast or Wyoming provides expert guidance to navigate the competitive property market. We compare loan options from multiple lenders to ensure you get the best rates and terms. Whether you’re buying a family home, an investment property, or refinancing, our services are tailored to your financial goals. With Wyoming’s median home prices and strong rental yields, now is an opportune time to secure financing with the help of a mortgage broker in Wyoming.

We also assist with understanding market trends, such as the impact of low inventory and rising mortgage rates, which currently fluctuate between 6.23% and 7.0% in the Wyoming market. Pre-approval is crucial in a competitive market like Wyoming, where properties sell quickly. Contact our mortgage broker in the Central Coast team to streamline your home-buying journey.

Explore our home loan services, investment property loans, or refinancing options.

Local Real Estate Agents in Wyoming

Partnering with a reputable real estate agent is essential when buying or selling in Wyoming. Below is a table of trusted real estate agent websites operating in the Wyoming, NSW suburb, ensuring you can connect with professionals to complement our mortgage broker services on the Central Coast and in Wyoming.

| Real Estate Agency | Website | Contact Details | Services Offered |

|---|---|---|---|

| Domain Real Estate | www.domain.com.au | Online contact form | Property sales, rentals, market reports |

| Real Estate Investar | www.realestateinvestar.com.au | Online contact form | Investment property tools, market analysis |

| RateMyAgent | www.ratemyagent.com.au | Online agent profiles | Agent reviews, property sales |

| TenantApp | www.tenantapp.com.au | Online contact form | Rental property listings |

| Your Investment Property | www.yourinvestmentpropertymag.com.au | Online contact form | Property market data, investment advice |

Investment Opportunities in Wyoming

Wyoming’s property market is particularly appealing for investors due to its strong rental yields and low vacancy rates. The Central Coast’s growing population, expected to increase significantly by 2034, drives demand for both owner-occupied and rental properties. Single-family homes remain popular for long-term investment, while units offer higher rental yields, making them ideal for investors seeking to maximise cash flow. A mortgage broker on the Central Coast can help you explore loan options for various property types, ranging from single-family homes to multi-family dwellings.

The suburb’s proximity to the University of Newcastle Central Coast campus and TAFE NSW Gosford campus attracts students, boosting demand for rental units. With Wyoming’s median rent for units at $485 per week, investors can achieve consistent returns. Our mortgage broker in Wyoming services include investment property financing, helping you maximise returns in this dynamic market.

Tips for First-Time Homebuyers in Wyoming

First-time homebuyers in Wyoming should consider the following tips to succeed in this competitive market:

- Get Pre-Approved: Work with a mortgage broker in Wyoming to secure pre-approval, giving you a competitive edge in a tight market.

- Understand Market Trends: Stay informed about median house prices, rental yields, and stock turnover to make strategic offers.

- Explore Loan Options: A mortgage broker in the Central Coast can compare loans to find the best rates and terms for your budget.

- Partner with Local Experts: Utilise our recommended real estate agents to find properties that align with your specific needs.

- Consider Investment Potential: Even first-time buyers can benefit from Wyoming’s strong rental yields if considering a future investment.

Contact Our Mortgage Broker in Wyoming Today

Ready to explore the Wyoming, NSW property market? Our mortgage broker in Central Coast and Wyoming is here to help. We offer personalised mortgage solutions, whether you’re buying your first home, investing in a rental property, or refinancing an existing loan. Contact us today to discuss your home loan needs and take the first step toward owning a property in Wyoming, NSW.

Learn more about our home loan services, investment loans, or refinancing advice.

The right home loan for your needs

Our mission is to find the right home loan for your individual needs and to always have your best interests at heart. Plain and simple. Which is why we have such a wide range of lenders to choose from. We can search through hundreds of products to find something tailored to your situation. ~