Mortgage Choice in Killarney Vale

Mortgage Choice in Killarney Vale - Michael Daniels and Philip Cooper

Book an Appointment with Michael Daniels, Mortgage Broker Killarney Vale

Get Directions to Our Central Coast Office

UPDATE | Employment is the key to Killarney Vale Property Prosperity | 24/06/2025

One of the most important economic indicators from a bank's perspective is a market's employment profile. High unemployment leads to high delinquencies, low housing demand and higher levels of distressed selling. All of this feeds into lower property prices and higher risk from a bank's perspective. For this reason, it is beneficial for all property owners to closely monitor employment trends, as I often say, because if the banks are concerned, investors should be concerned as well.

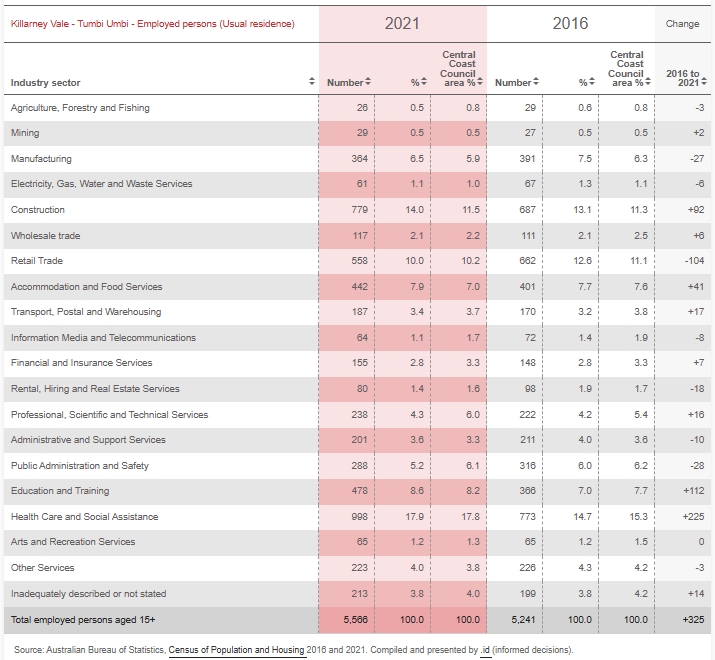

The good news for Killarney Vale is that its unemployment rate remains low, and the industry's employment diversification is relatively stable. The table below illustrates the diverse range of employment industries represented by Killarney Vale residents.

The census data for Killarney Vale-Tumbi Umbi from 2016 to 2021 shows a total of employed persons aged 15 and above increasing from 5,241 to 5,566 (+325). The biggest growth sectors include Health Care and Social Assistance, which rose from 773 to 998 (+225, a 17.8% share in 2021), and Education and Training, growing from 386 to 478 (+112, a 7.7% share). These reflect rising demand in public services.

The most significant declines occurred in Retail Trade, which dropped from 662 to 558 (-104, a 11.1% share reduction), and Manufacturing, decreasing from 391 to 364 (-27, a 6.3% decline). However, Construction grew from 687 to 779 (+92), suggesting an increase in infrastructure.

This indicates a shift towards service industries, with health and education expanding, while retail and manufacturing face challenges. The Central Coast Council's employment distribution remained stable, with minor shifts in percentage.

Banks and property owners will closely watch the 2026 Census. I suspect the trend toward service industries will only grow.

If you would like to discuss your property plans, please get in touch with us at Mortgage Choice Central Coast in Erina.

UPDATE | Killarney Vale Market Profile | 28/05/2025

Nestled between Tuggerah Lake and the Pacific Ocean, Killarney Vale is a tranquil coastal suburb on the Central Coast of New South Wales, just 93 kilometres north of Sydney’s CBD. With its postcode 2261, this family-friendly locale offers affordability, a relaxed lifestyle, and strong investment potential. Its proximity to vibrant hubs like The Entrance and Bateau Bay makes it a popular choice for families, retirees, and property investors. Whether you’re exploring your first home purchase or seeking investment opportunities, understanding Killarney Vale’s property market trends is essential. Partnering with a local Mortgage Broker in Killarney Vale or an experienced Mortgage Broker on the Central Coast can help you navigate financing options tailored to this dynamic market.

Why Choose Killarney Vale?

Killarney Vale is renowned for its laid-back atmosphere, scenic lakefront, and easy access to pristine beaches. With a population of around 7,213 (2016 Census) and a 3.8% population growth between 2011 and 2016, the suburb spans approximately 3 square kilometres. Its 11 parks, covering nearly 18.7% of the area, make it a haven for outdoor enthusiasts. The demographic includes many couples with children, with a significant number of residents working in trades. About 70.4% of homes are owner-occupied, reflecting a strong homeownership culture, while 30% are rented, appealing to investors. For those considering a property purchase, a Mortgage Broker in Killarney Vale can offer valuable insights into financing solutions suited to this vibrant community.

Killarney Vale Property Market Trends

The Killarney Vale property market remains resilient, driven by its affordability compared to Sydney, appealing lifestyle, and ongoing infrastructure developments. Below, we outline key trends in rentals and sales to help you make informed decisions, whether you’re working with a Mortgage Broker on the Central Coast or a Mortgage Broker in Killarney Vale.

Rental Market Insights

Killarney Vale’s rental market is thriving, with strong demand and limited supply pushing rents upward. This makes the suburb particularly attractive for investors seeking consistent returns. Key rental metrics include:

- Median Weekly Rents: Houses in Killarney Vale have a median weekly rent of approximately $596, while units typically fetch around $650 per week. These figures highlight the suburb’s appeal to families and young professionals drawn to its coastal charm.

- Rental Yields: The median gross rental yield for houses is around 3.33%, exceeding the 3% benchmark often recommended for investors. Townhouses and apartments frequently offer higher yields, making them ideal for holiday rentals or long-term leases.

- Demand and Supply: High tenant demand, particularly from families and retirees, coupled with limited rental stock, creates a competitive market. The broader Central Coast region, including Killarney Vale, is seeing increased interest due to its affordability compared to Sydney, with rental prices projected to rise by 10-15% in the coming years.

Sales Market Insights

The sales market in Killarney Vale is driven by first-home buyers, families, and investors, with steady growth in property values. Key sales metrics include:

- Median Sales Prices: The median house price is around $900,000, with some sources noting a typical price of $929,538. Units have a median sale price of approximately $530,000, offering an affordable entry point compared to Sydney’s market.

- Sales Volumes: Over the past 12 months, Killarney Vale recorded 121 house sales, with an average sale price of $908,714. Properties typically spend 31-36.62 days on the market, indicating a relatively fast-paced sales environment.

- Growth Rates: House prices have achieved an annual growth rate of 8.4%, reflecting strong demand and limited supply. However, a recent 8.22% annual decline in median sale prices suggests short-term fluctuations that buyers should monitor.

- Market Dynamics: A tight housing supply and robust buyer interest create a competitive market. Infrastructure improvements, such as new roads and transport links, are expected to further boost property values in the coming years.

Factors Shaping the Killarney Vale Market

Several factors contribute to the strength of Killarney Vale’s property market:

- Affordability: Compared to Sydney, where median house prices surged by 8% last year, Killarney Vale offers a more accessible entry point for homebuyers and investors.

- Lifestyle Benefits: The suburb’s coastal setting, with access to Tuggerah Lake, beaches, and parks, attracts sea-changers and families seeking a balanced lifestyle.

- Infrastructure Growth: Regional projects, including improved transport links, enhance connectivity to Sydney and Newcastle, driving property demand.

- Demographic Trends: An influx of families and young professionals from urban centres is increasing demand for both rentals and purchases.

- Interest Rate Outlook: Expected interest rate cuts in 2025 are likely to encourage property purchases, particularly for first-home buyers working with a Mortgage Broker in Killarney Vale.

How a Mortgage Broker Can Help

Navigating the Killarney Vale property market can be complex, but a Mortgage Broker on the Central Coast or a Mortgage Broker in Killarney Vale can provide expert guidance. They offer support by:

- Assessing loan options tailored to your financial circumstances.

- Connecting you with lenders offering competitive rates for properties in Killarney Vale.

- Providing insights into market trends and affordability considerations to help you make informed decisions.

With the Central Coast property market set for growth, a mortgage broker’s expertise can be invaluable for homebuyers and investors alike.

Local Real Estate Agents in Killarney Vale

Working with a local real estate agent is key to success in Killarney Vale’s property market. The table below lists prominent agencies operating in the suburb, along with their website links:

| Real Estate Agency | Website |

|---|---|

| Wiseberry Killarney Vale | wiseberry.com.au |

| Raine & Horne Killarney Vale/The Entrance | raineandhorne.com.au |

| LJ Hooker Tumbi Umbi | Killarney Vale | Bateau Bay | tumbiumbi.ljhooker.com.au |

| LocalAgentFinder (Agent Comparison Service) | localagentfinder.com.au |

These agencies offer specialised knowledge of the Killarney Vale market, with an average commission rate of 2.32%. Platforms like LocalAgentFinder can help you compare agents to find the best match for your needs.

Property Market Outlook for 2025

Killarney Vale’s property market is poised for continued growth in 2025, driven by several key factors:

- Rental Market: Limited supply and strong tenant demand are expected to drive rental price increases of 10-15%, offering attractive yields for investors.

- Sales Market: Anticipated interest rate cuts are likely to boost buyer activity, particularly among first-home buyers and investors.

- Infrastructure Benefits: Improved transport links will enhance the suburb’s appeal, supporting long-term capital growth.

- Affordability Edge: Killarney Vale remains a cost-effective alternative to Sydney, appealing to those seeking value and lifestyle benefits.

Final Thoughts

Killarney Vale’s residential property market offers a unique blend of affordability, coastal charm, and strong investment potential. With median house prices around £900,000, rental yields of 3.33%, and an annual growth rate of 8.4%, the suburb is a prime destination for homebuyers and investors. The competitive rental market, with median weekly rents of £596 for houses, underscores its appeal. Partnering with a Mortgage Broker in Killarney Vale or a Mortgage Broker on the Central Coast can help you explore financing options. At the same time, local real estate agents offer expertise in buying, selling, or renting properties. As the market evolves in 2025, staying informed and collaborating with professionals will be crucial for success in this vibrant suburb.

Learn more about our home loan services, investment loans, or refinancing advice.